News & Events

Press Releases

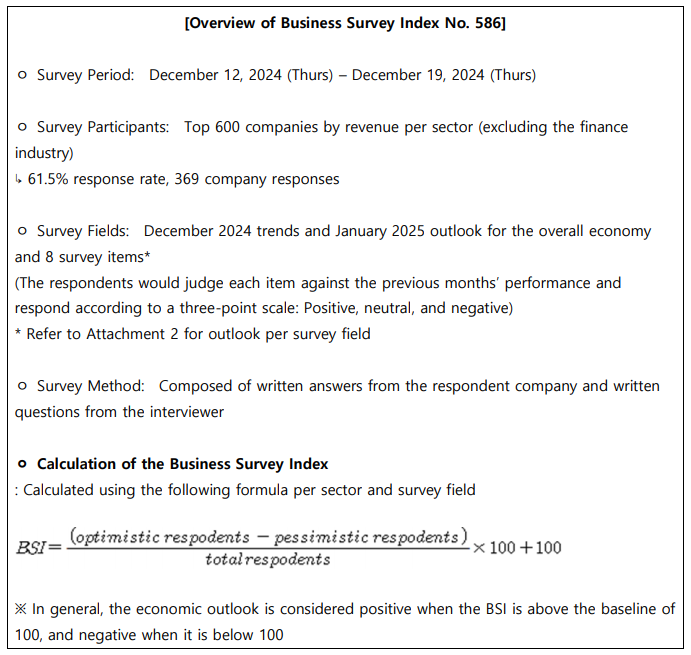

January Outlook Business Survey Index (BSI)

|

Business sentiment frozen solid,

January BSI (84.6) drops dramatically by 12.7p (on the prior month)

- The drop in BSI of △12.7p is the sharpest decline in 4 years and 9 months since measures were put in place against COVID-19 (April 2020 △25.1p↓)

- Duration of consecutive negative BSI (below 100) has also continued for 2 years and 10 months, the longest ever period on record

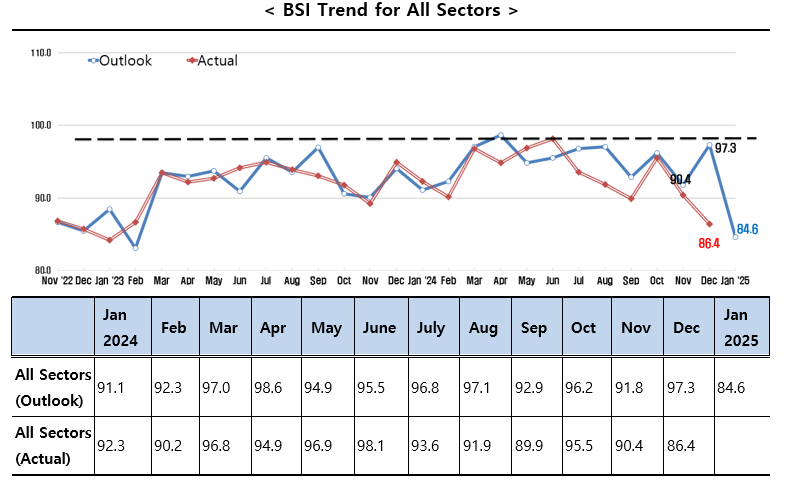

- [BSI by Sector] The manufacturing sector (84.2) and the non-manufacturing sector (84.9) both remain negative

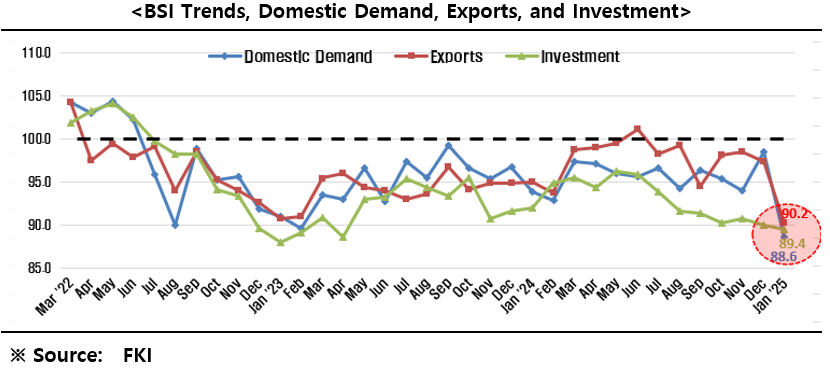

- [BSI by Survey Field] Domestic demand (88.6), Exports (90.2), Investment (89.4); These three fields have been negative for 7 consecutive months

* Domestic demand: Lowest in 4 years and 4 months since September 2020 (88.0); Exports: Lowest in 4 years and 3 months since October 2020 (90.2)

- There is a need to focus on policies for stabilizing exchange rates and reviving the economy and a need to refrain from discussions on revising the Commercial Act which may contribute to additional uncertainties in business management

The Federation of Korean Industries (FKI)’s Business Survey Index (BSI), a survey of the business sentiment of the largest 600 Korean companies in revenue, recorded an outlook of 84.6 for January 2025, falling short of the baseline of 1001) for 2 years and 10 months since April 2022 (99.1). This marks the longest-ever period of back-to-back negative BSI figures since the beginning of the survey in 1975.

1) A BSI outlook that surpasses 100 signifies positive business sentiment for the overall economy, relative to the prior month, and vice versa.

3) BSI Outlook for the Manufacturing Sector : 100.5 (March 2024), 98.4 (April), 95.5 (May), 95.9 (June), 88.5 (July), 94.8 (August), 93.9 (September), 96.4 (October), 91.1 (November), 89.9 (December), and 84.2 (January)

4) BSI Outlook for the Non-manufacturing Sector : 105.5 (July 2024), 99.5 (August), 91.9 (September), 96.0 (October), 92.5 (November), 105.1 (December), and 84.9 (January 2025)

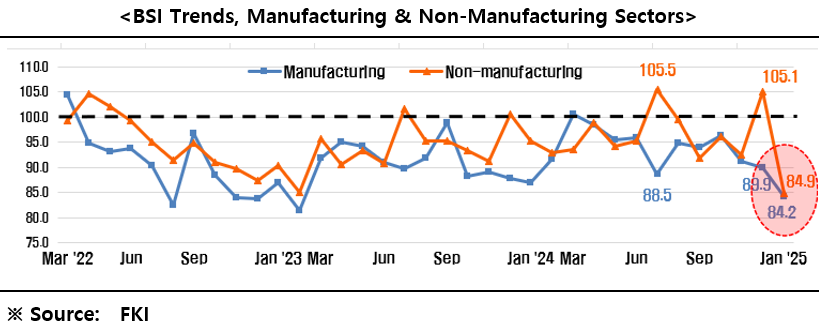

Among the 10 industries in the manufacturing sector, ▸Electronics & telecommunications equipment (105.3) reported the only positive outlook. Aside from ▸Pharmaceuticals (100.0), the outlook for the remaining 8 industries5) are negative.

5) ▸Textiles, clothing, leather & footwear (53.8) ▸Non-metallic materials and products (78.6) ▸Food, beverage and tobacco (82.4) ▸Metals and processed metal products (82.8) ▸General machinery, precision machinery and equipment (84.2) ▸Petroleum refining and petrochemicals (85.2) ▸Automobiles and other transportation equipment (85.3) ▸Wood, furniture and paper (87.5)

Among the 7 industries in the non-manufacturing sector, ▸Transportation and storage (103.8) reported the only positive outlook. Aside from ▸Electricity, gas, water supply (100.0), and ▸Leisure, accommodation & food services (100.0), which were on the baseline, the outlook for the remaining 4 industries6) are negative.

6) ▸Construction (68.2) ▸Professional, scientific, technical & business support services (78.6) ▸Information and communication (81.3) ▸Wholesale and retail (83.3)

It is FKI’s view that the non-manufacturing sector’s business sentiment will improve around the Transportation and storage sector, in which direct demand increases are expected at the year’s end and start of the new year.

In all survey fields among the January BSI7)8), all items indicate negative business sentiment. The 3 survey fields, Domestic demand (88.6), Exports (90.2), Investment (89.4) have all been negative for 7 consecutive months since July 2024.

7) ▸Domestic demand 88.6 ▸Investment 89.4 ▸Employment 90.0 ▸Exports 90.2 ▸Financial condition 92.1 ▸Profitability 94.0 ▸Inventory 104.9

8) Inventory surpassing the baseline (100) indicates negative outlook

Notably, the BSI for Domestic demand (88.6) reached record lows in 52 months since September 2020 (88.0) and the BSI for Exports (90.2) was the lowest in 51 months since October 2020 (90.2), recording negative outlooks for both domestic demand and exports. The BSI for Investment (89.4) recorded the lowest figures in 21 months since April 2023 (88.6).

Sang-ho Lee, head of FKI’s Economic and Industrial Research Department remarked, “There are heightened concerns, including higher exchange rate volatility9) and prolonged slowdowns in domestic demand10), due to external corporate management landscape shifts, including the incoming Trump administration. He maintained, “Concentrated efforts are needed to revive the economy, including measures to stabilize the exchange rate and support to revitalize industries.11) Additionally, there is a need to refrain from discussions of legislative activities12) which may exacerbate corporate management uncertainties.

9) KRW/USD exchange rate trends (at period-end) : 1,270.0 (December 2022)→ 1,294.0 (December 2023)→ 1,450.6 (December 20, 2024)

10) Q3 Retail sales indices recorded -1.9%, YoY, indicating a decline for 10 consecutive quarters

11) ex) Special Act on the Semiconductors Industry, Special Act on Securing Core National Power Grids, and extending the sunset period for R&D tax credits for national strategic technologies

12) ex) Amendments to the Commercial Act to expand the duty of loyalty by directors to shareholders, etc.