News & Events

Press Releases

Comparison : South Korean and Chinese High-tech Industry Exports Competitiveness

|

Since 2022, China has already surpassed Korea in high-tech industry1) exports competitiveness

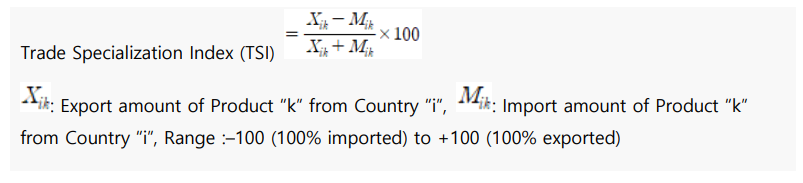

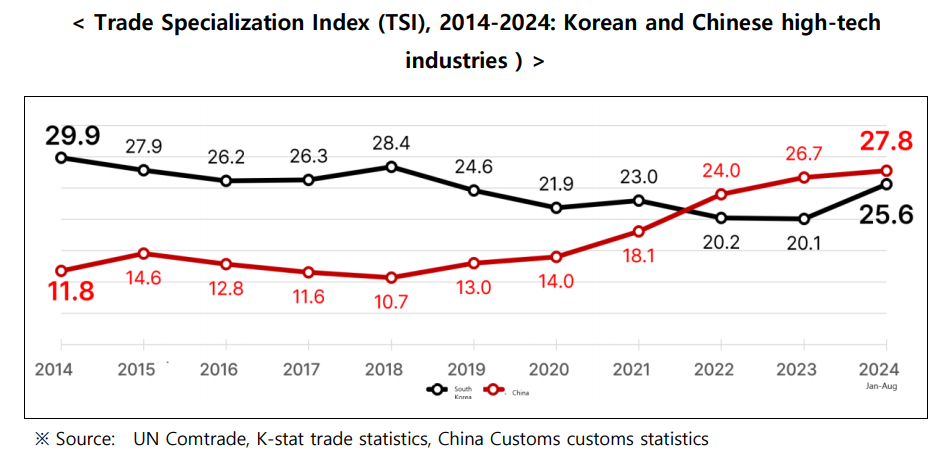

• Trends in Trade Specialization Index (TSI) for High-tech Industries2) :

(2014) Korea 29.9 > China 11.8 → (Jan-Aug 2024) Korea 25.6 < China 27.8

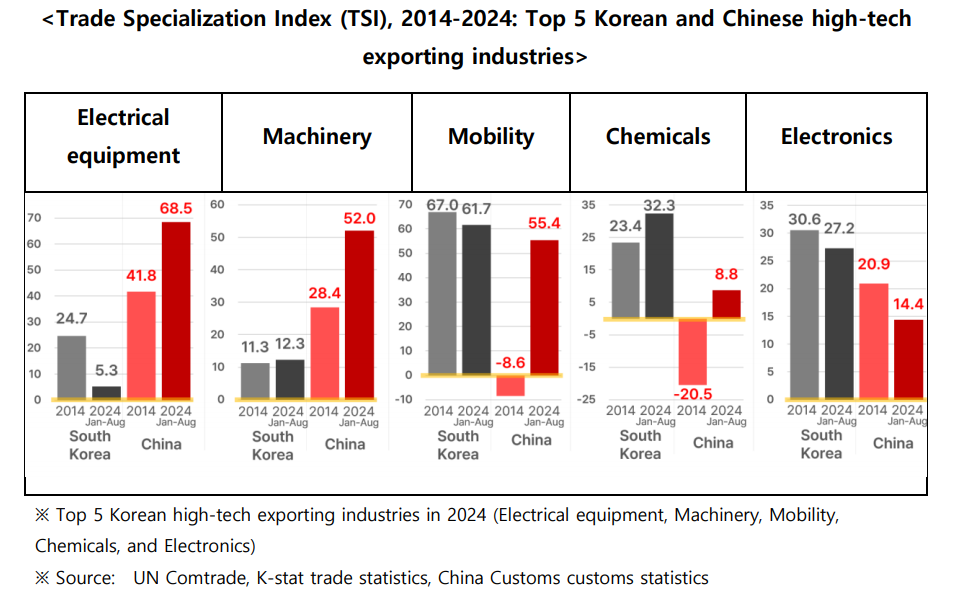

• Most Chinese high-tech industry exports competitiveness on the rise–including the Electrical equipment, Machinery, Mobility, and Chemicals industries

■ China already holds competitive edge over Korea in Electrical equipment and Machinery; Mobility and Chemicals have reached net exporter levels in 2018 and 2022 respectively, threatening to overtake Korea

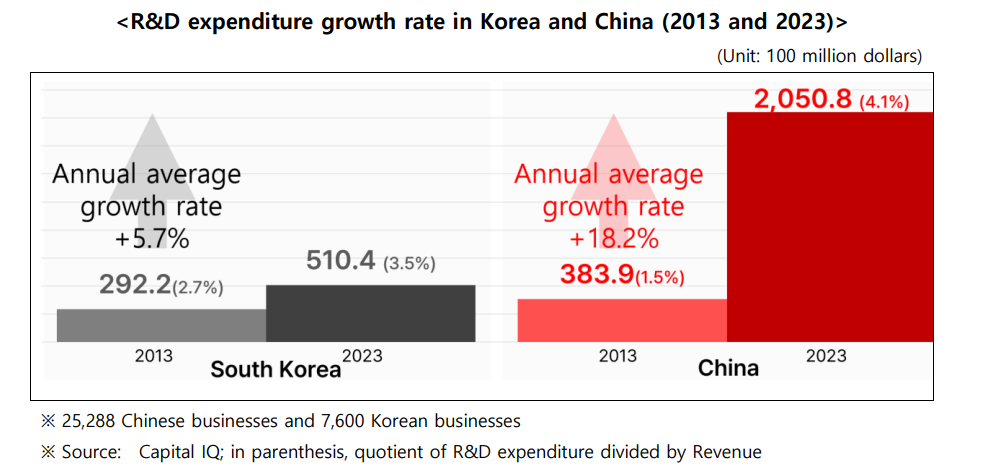

• Korean high-tech businesses’ R&D expenditure at 24.9% of China’s; Korea’s ratio of R&D spending against revenue is also lower than that of China (0.6%p)

■ Ratio of R&D expenditure against revenue : Korea 3.5% < China 4.1%

• Recommended key tasks to bolster high-tech industry competitiveness :

■ ①Extend the sunset period for national strategic technologies, ②Expand the scope of national strategic technologies designation, ③Adopt a negative-list approach to designation of national strategic technologies, ④Adopt the direct pay system and extending the period for tax credit carry-overs, ⑤Expand targets for facilities investment tax credits

1) The high-tech industry refers to High R&D intensity industries (Electronics, Medical and optical products, Pharmaceuticals and biotechnology, and Aerospace industries) and Medium-high R&D intensity industries (Mobility, Chemicals, Machinery, and Electrical equipment) as categorized by the OECD Taxonomy of Economic Activities Based On R&D Intensity

* The higher the R&D intensity in an industry, the higher the ratio of R&D expenditure against the gross value added (GVA) for 1 year; this illustrates the importance of technological capability

2) Trade Specialization Index : An index that shows the comparative advantage a certain product. A negative (-) index figure indicates net imports; a positive (+) figure indicates net exports. A higher figure signifies higher competitiveness.

There is concern that with Korea having fallen behind China in exports competitiveness since 2022, Korea’s competitive gap with China may widen further due to Korean high-tech businesses’ R&D expenditure falling short of China’s. The Federation of Korean Industries (hereinafter, ‘FKI’) released an analysis report based Korean and Chinese high-tech industries’ exports and imports data as well as their financials3).

3) Exports and imports data were captured from UN Comtrade; K-stat data (from the Korea International Trade Association); and the customs statistics database (from the General Administration of Customs of the People’s Republic of China (GACC/China Customs)). Businesses’ financial data were captured from the Capital IQ database.

High-tech industry Trade Specialization Index (TSI), Jan-Aug 2024 : Korea 25.6 < China 27.8; Korea lags behind China for 3 consecutive years

According to the FKI’s calculation of the high-tech industry’s Trade Specialization Index (TSI), an index for measuring exports competitiveness, Korea was 25.6 and China was 27.8 during the January-August period of 2024. China’s high-tech industry TSI was up 16.0 points compared to 10 years ago in 2014, indicating that the Chinese high-tech industry export competitiveness has risen, but during the same period, Korea’s TSI fell by 4.3 points. Korea’s high-tech industry TSI in 2014 was 29.9, well surpassing China’s TSI of 11.8. However, Korea no longer held the lead as of 2022, lagging behind China for 3 consecutive years.

Calculations of the high-tech industry TSI for Jan-Aug 2024 showed that China had overtaken Korea in the Electrical equipment and Machinery categories, meaning that China had higher exports competitiveness in these industries. In the Electrical equipment and Mobility industries, Korea’s TSI in 2024 compared to 2014 fell by 19.4 and 5.3 points respectively. In contrast, China’s TSI in those industries rose by 26.7 and 64.0 points respectively. Notably, China’s TSI in the Mobility industry (since 2018) and the Chemicals industry (since 2022) have turned positive (net exporter), signifying that China is engaged in competition with Korea4).

4) See Attachment (Trends in Trade Specialization Index by Industry)

Chinese high-tech businesses outspend their Korean peers by 4-fold in R&D expenditure in 2023

An analysis of Korean and Chinese businesses’ financial statement data5) by the FKI revealed that in 2023, Korean high-tech businesses spent 51.04 billion dollars in R&D expenditure, amounting to 3.5% of revenue. In the same year, Chinese high-tech businesses’ R&D expenditure was 205.08 billion dollars, a 4-fold amount against Korean R&D expenditure, amounting to a higher percentage (4.1%) of revenue spent on R&D than Korean businesses. In terms of R&D expenditure growth rate, Korea’s R&D expenditure has risen by an average of 5.7% annually since 2013. However, China’s spending has recorded an annual average of 18.2%, vastly outstripping Korean growth rates.

5) Captured data from S&P Global Capital IQ, data captured from 32,888 businesses’ R&D expenditure on ▸revenue from 2013-2023, ▸from both public (listed) and private (unlisted) companies ▸ headquartered in Korea and China

Improvements to investment tax credits necessary for bolstering competitiveness of high-tech industries

The FKI observes that in order to secure a competitive advantage globally in high-tech industries, investments need to become sizably bigger than current levels. The FKI recommends renovating current policies and providing all-round support to encourage Korean high-tech businesses to invest more actively in R&D.

[➊ Extend the sunset provision period for national strategic technologies] Under the current Act on Restriction on Special Cases Concerning Taxation, there are tax credit benefits for R&D and commercialization facilities related to national strategic technologies6) . The sunset provisions on these benefits, however, mean that benefits will end as of this year. Transitioning from investment to generating profits takes considerable time in high-tech industries, so, ending benefits would hinder long-term investment decisions. Therefore, the FKI stresses the importance of extending the period for sunset provisions.

6) National strategic technologies refer to technologies that have significant potential effects on national security and the national economy. They are composed of 7 categories (semiconductors, rechargeable batteries, vaccines, display, hydrogen, future mobility, and biotechnology & pharmaceuticals) which include 66 technologies.

[➋Expand the scope of national strategic technologies designation] Under current law, national strategic technologies need to be designated under an ‘industrial category.’ Then, a ‘technology,’ deemed important within that industry, which meets the requirements for designation, can be specified. However, the 7 industrial categories may be insufficient to meet requirements arising from the fast-moving innovations in technologies. The FKI therefore recommends giving serious consideration to adding new promising new & emerging industrial categories to the list of national strategic technologies, including AI, defense, and nuclear power.

[➌ Adopt a negative-list approach in designation of national strategic technologies] Under current law, designation of national strategic technologies require adhering to detailed requirements specific to industrial categories that are outlined by law. However, the current positive-list approach does not allow for tax credit benefits going to a high-tech area if it fails to fall under a pre-specified legal requirement. The FKI, therefore, recommends the adoption of a negative-list approach instead of a positive-list approach so that legal requirements may be flexibly applied to innovative technologies.

[➍ Adopt a direct pay system and extend the period for tax credit carry-overs] Under current law, if a business is operating at a loss and is exempt from taxation, it would not benefit immediately from tax credits. Instead, if that same business becomes profitable within the next 10 years, it may carry forward and apply the unused tax credits. However, there is fierce competition in high-tech industries, which means turning stable profits are difficult. It is uncertain that investments would generate profits in the short term. This may limit the effectiveness of support given under current law. The FKI, therefore, recommends the adoption of a direct pay system7) or to extend the period for tax credit carry-overs.

7) Direct pay system : A system where the difference or the entirety of the tax credit is paid out in cash if a business cannot fully benefit from a tax credit in an applicable year. This system is being implemented under the U.S. Inflation Reduction Act (IRA).

[➎Expand targets for facilities investment tax credits] Under current law, eligibility for facilities investment tax credit is limited to ‘tangible business assets, including machinery and equipment,’ and ‘commercialization facilities’. Tangible assets, including land and buildings as well as R&D facilities and equipment are excluded from qualifying for tax credits. However, there is a high ratio of facilities investment in land and buildings (30-50%) necessary for high-tech industries. Also, sustained R&D investments are critical to technology innovations. In consideration of these characteristics, the FKI observes that there is a need to expand the targets for facilities investment tax credits.

Sang-ho Lee, head of FKI’s Economic and Industrial Research Department observed, “The relative size difference between Korean and Chinese businesses mean that Korean businesses are disadvantaged in the high-tech industry race if they operate at the same pace as their Chinese peers.” He added, “For Korean high-tech industries to be as competitive as their Chinese counterparts, various booster policies must be provided, including in tax credits, investment subsidies, and electricity and water infrastructure.”

※ [Attachment] Reference Data : South Korean and Chinese high-tech industry exports and businesses data