News & Events

Press Releases

December Business Survey Index (BSI) Released

|

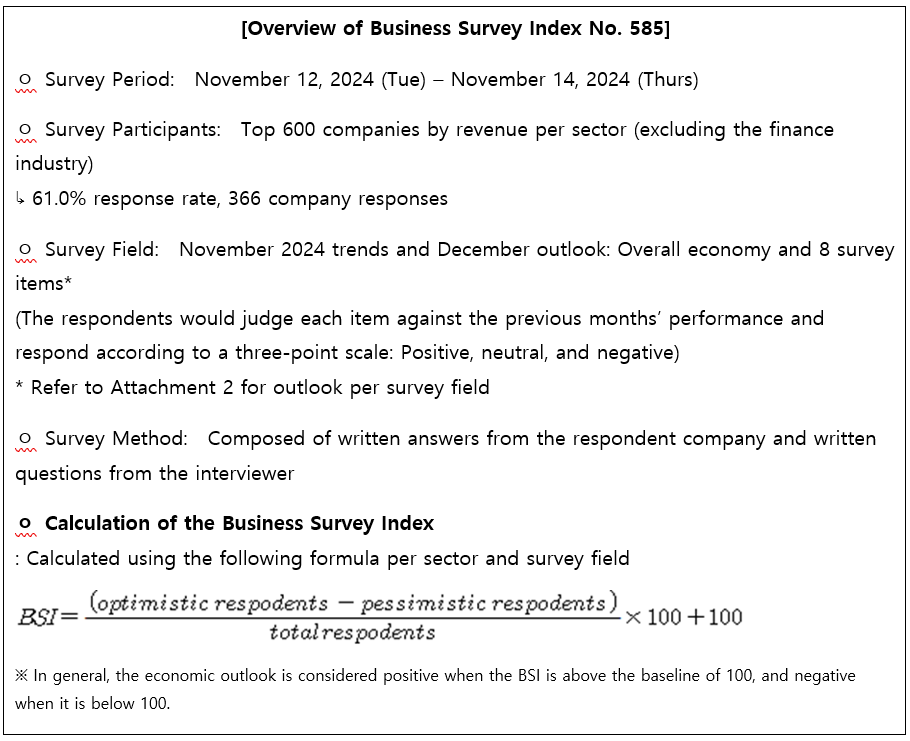

December BSI at 97.3, matching the longest-ever period of sluggishness

• Overall BSI outlook (97.3), negative for 33 consecutive months since April 2022 (99.1)

* Negative outlook for BSI for 33 consecutive months : Matches longest-ever period of successive negative outlook

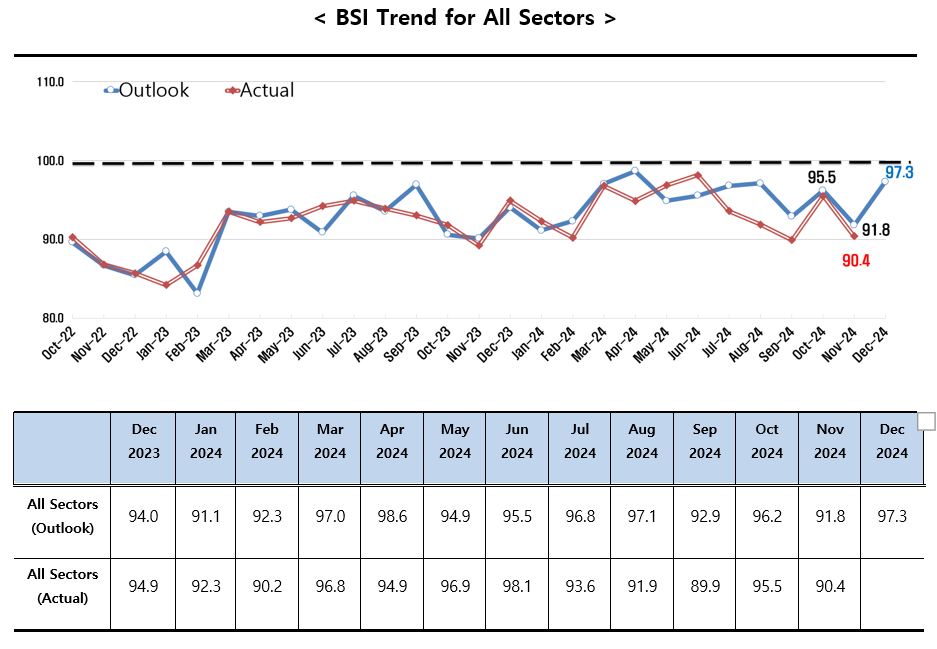

• [BSI by Sector] There is a diverged outlook between the manufacturing sector (89.9) and the non-manufacturing sector (105.1)

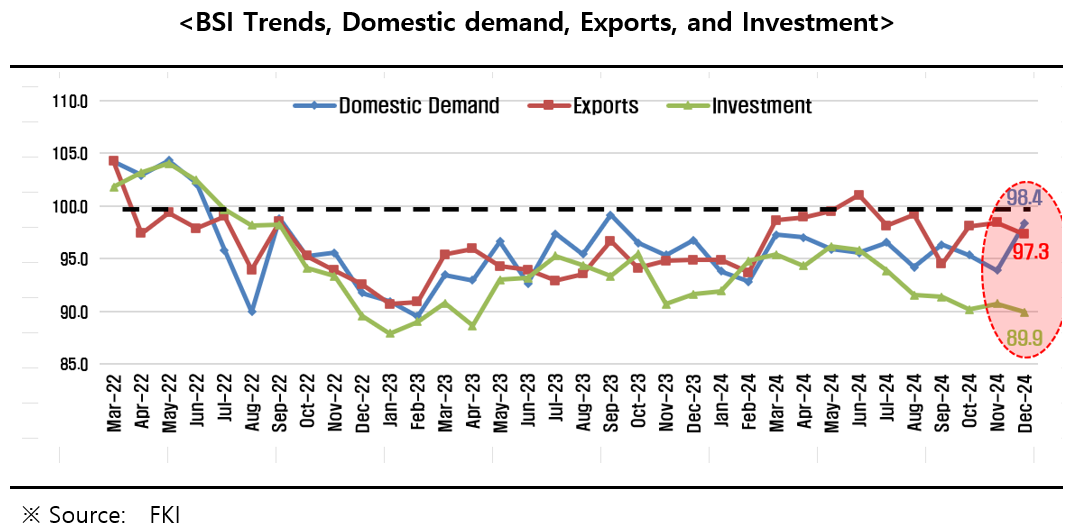

• [BSI by Survey Field] Domestic demand (98.4), Exports (97.3), Investment (89.9); These three fields have been negative for 6 consecutive months

* [Investment] The Investment survey field recorded the lowest figures in 20 months since April 2023 (88.6), indicating continued deterioration of investment sentiment

• Korean businesses are stretched to the limit; there is a need to refrain from regulatory legislation which heightens uncertainties for businesses, such as amendments to the Commercial Act

* In terms of the securities market, operating profits dropped for 12 industries out of 17 in the 3Q 2024

The Federation of Korean Industries (FKI)’s Business Survey Index (BSI), a survey of the business sentiment of the largest 600 Korean companies in revenue, recorded an outlook of 97.3 for December 2024, falling short of the baseline of 100.

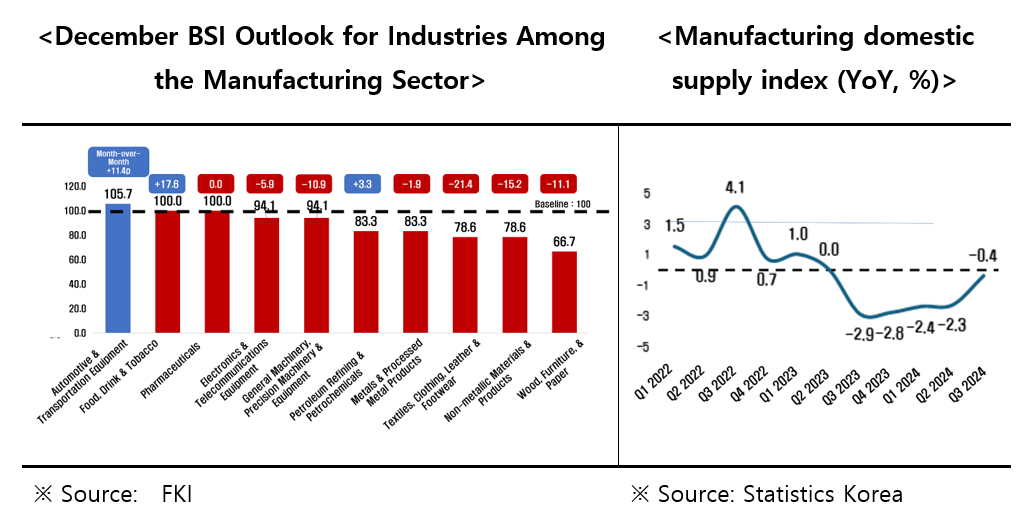

There was a sectoral divergence in the December BSI outlook. The manufacturing sector BSI2) was 89.9, recording sub-90 figures for the first time in 5 months since July 2024 (88.5). The FKI noted that the manufactoring sector’s business sentiment has been deteriorating and this was evident by 5 consecutive quarters of negative supply3) in domestic manufacturing goods due to prolonged effects of sluggish domestic demand.

2) BSI Outlook for the Manufacturing Sector :88.5 (July), 94.8 (August), 93.9 (September), 96.4 (October), 91.1 (November), 89.9 (December)

3) Manufacturing domestic supply index (Statistics Korea, YoY, %) : 1.0(Q1 2023)→ 0.0(Q2 2023)→ -2.9(3Q 2023)→ -2.8(4Q 2023)→ -2.4(1Q 2024)→ -2.3(2Q 2024)→ -0.4(3Q 2024)

The non-manufacturing sector BSI4) was 105.1, up 12.6 points compared to the previous month. It was the first time in 5 months since July that the sector’s BSI recorded above-100 figures. The FKI attributed these results to heightened expectations for a surge in sales at the year’s end and increased demand for heating.

4) BSI Outlook for the Non-Manufacturing Sector : 105.5 (July), 99.5 (August), 91.9 (September), 96.0 (October), 92.5 (November), 105.1 (December)

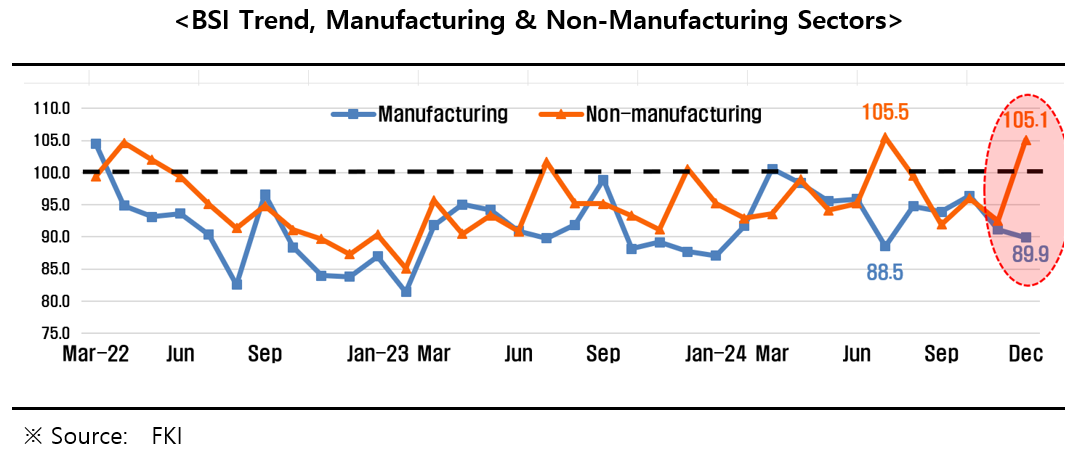

Among the 10 industries among the manufacturing sector, ▸General machinery, precision machinery and equipment (105.7) reported the only positive outlook. Aside from ▸Food, beverage and tobacco (100.0) and ▸Pharmaceuticals (100.0), which reported baseline figures (100), the outlook for the remaining 7 industries5) are negative.

5) ▸Wood, furniture and paper (66.7) ▸Textiles, clothing, leather & footwear (78.6) ▸Non-metallic materials and products (78.6) ▸Petroleum refining and petrochemicals (83.3) ▸Metals and processed metal products (83.3) ▸Electronics & telecommunications equipment (94.1) ▸General machinery, precision machinery and equipment (94.1)

The FKI viewed that the business sentiment in the Electronics & telecommunications equipment (94.1) industry, which includes semiconductors, is below the baseline because there was sluggish demand in home appliances and other consumer goods as well as an outlook6) for lower semiconductor prices due to China’s expanded capability to produce DRAM.

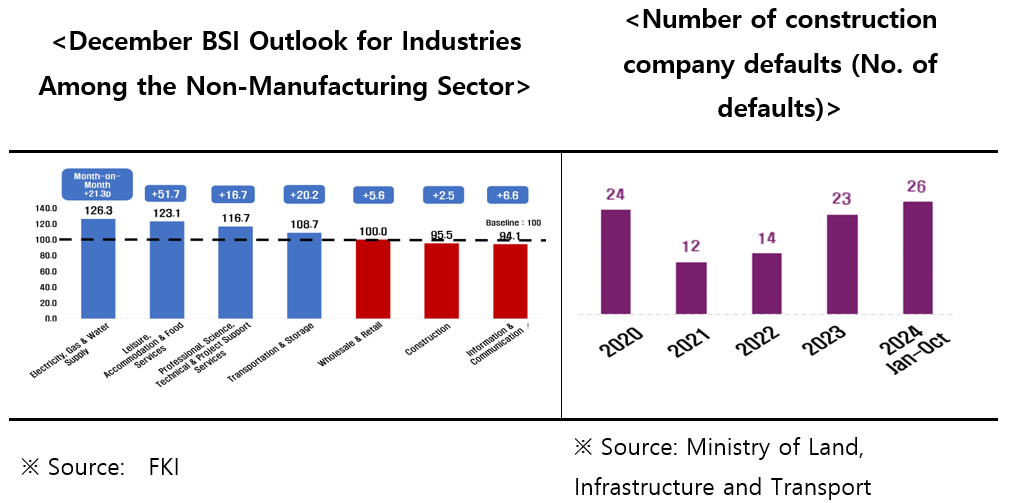

Among the 7 industries in the non-manufacturing sector, the ▸Electricity, gas, water supply (126.3), ▸Leisure, accommodation & food services (123.1), ▸Professional, scientific, technical & business support services (116.7), and ▸Transportation and storage (108.7) reported a favorable outlook. Aside from ▸Wholesale and retail (100.0), which reported baseline figures (100), the outlook for the remaining 2 industries7) are negative.

7) ▸Information and communication (94.1) ▸Construction (95.5)

The FKI expects that the non-manufacturing sector business sentiment will improve mainly due to the Electricity, gas, water supply sector’s seasonal demand and the Leisure, accommodation & food services and the Transportation sectors’ seasonal surge in sales.

In all survey fields among the December BSI, all items indicate negative business sentiment (▸Domestic demand (98.4), ▸Financial condition (97.5), ▸Exports (97.3), Profitability (95.9), ▸Employment (94.3), ▸ Investment (89.9) and ▸Inventory (104.6)8)). The 3 survey fields, Domestic demand (98.4), Exports (97.3), Investment (89.9) have been negative for 6 consecutive months since July 2024.

8) Inventory surpassing the baseline (100) indicates negative outlook (Excess Inventory)

Notably, BSI for Investment (89.9) has reached record lows in 20 months, showing the lowest figures since April 2023 (88.6), and businesses’ investment sentiment do not show signs of recovery.

Sang-ho Lee, head of FKI’s Economic and Industrial Research Department remarked, “Due to worsening external risk and slowdowns in domestic demand, operating profits in 12 of 17 Korean industries’ have decreased9) during Q3 2024.” He warned, “Currently, Korean companies are stretched to the limit10) due to deteriorating business performance,” and he asserted that, “This is a time for focusing on ways to achieve economic recovery, not a time to exacerbate uncertainties in business operations through various regulatory legislative activities such as amending the Commercial Act.”

9) The 12 industries which suffered drops to their operating profits in Q3 2024 (In terms of the securities market, YoY, KRX): ▸Construction ▸Non-metallic minerals ▸Services ▸Transportation equipment ▸Logistics ▸Precision medicine ▸Electricity and gas ▸Electronics and electric ▸Paper and wood ▸Steel and metals ▸Telecommunications ▸Chemicals

The 5 industries that saw increases to their operating profits in Q3 2024 (In terms of the securities market, YoY, KRX): ▸Machinery ▸Textiles and clothing ▸Transportation and storage ▸Food and beverage ▸Pharmaceuticals

10) Operating profits down 18% in Q3 2024, net profits down by 14.7% (706 listed companies, YoY)