News & Events

Press Releases

The Recent Economic Recovery in Greece, Spain, and Portugal and Its Broader Implications

|

Southern Europe Turns Crisis into Opportunity; Becomes Europe’s Growth Engine Through High-intensity Reforms

• The three Southern European countries which fell into a sovereign debt crisis 10 years ago became overperformers through market-friendly reform policies

• [Greece] Overcame crisis through market-friendly policies such as deep slashes to corporate taxes (29%→22%) and discarding populist and expansionary policies

• [Spain] Achieved economic recovery by actively spurring foreign investment and implementing high-intensity structural reforms in areas such as labor and finance

• [Portugal] Identified future growth drivers in innovation and entrepreneurship, such as fostering and attracting startups

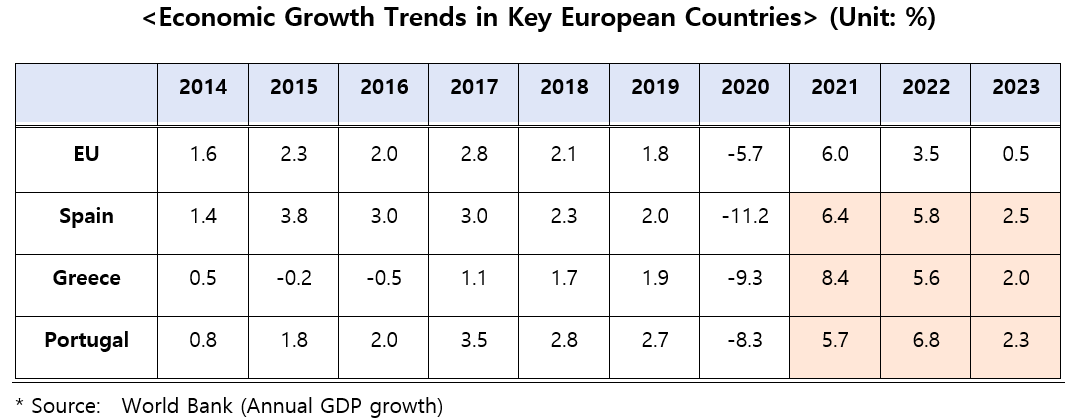

Once referred to as the “economic basket cases of Europe,” Southern European countries that fell into sovereign debt crisis in the 2010s have now become overperformers and drivers of economic growth in Europe. In the recent 3 years, the three Southern European countries — Spain, Portugal, and Greece — have recorded economic growth rates which top the list among EU countries. Greece, once having to default on its loans, has now strengthened its economic fundamentals.

The Federation of Korean Industries (hereinafter, FKI) analyzed the three Southern European countries’ policies and economic achievements of the past 10 years and found that Greece, Spain, and Portugal’s overperformance bore fruit from the effects of austerity measures and market-friendly structural reforms.

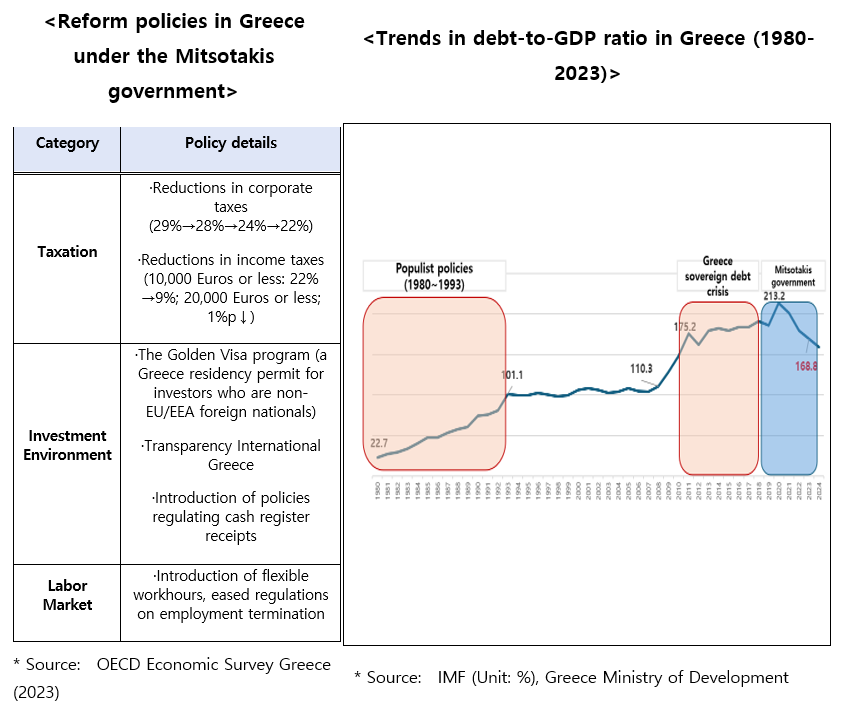

Greece turns the corner on economic recovery through market-friendly policies, such as slashing corporate taxes... Achieves a recovery in sovereign credit rating

Despite going through the severe sovereign debt crisis of 2012 and having to once default on its loans, Greece has recently recorded economic growth rates that surpass the EU’s, and earned the title, “Country of the Year for 20231)” from The Economist. Between the 1980s and 1990s, Greece implemented far-reaching and populist welfare expansions, including a free and universal health care system, a tuition-free education system, real increases to pensions, and increases to public sector employment. These expansionary measures led to a drastic accumulation of sovereign debt, with the debt-to-GDP ratio climbing from 22.7% in 1980 to 101.1% in 1993, which later contributed to the Greek government-debt crisis.

1) The Economist selected and evaluated OECD’s 35 member countries comprehensively across five criteria: ① core inflation index, ② GDP growth rate, ③ stock returns, ④ inflation rate, and ⑤ employment growth rate.

The Mitsotakis administration (New Democracy Party) came into office in 2019 and implemented austerity measures in line with recommendations from the EU. The administration also actively carried forward market-friendly policies, including reforming the investment landscape and slashing taxes. Corporate taxes, which were at 29% when Mitsotakis took office, were lowered in stages to 22%, and initiatives aiming to foster a business-friendly environment were carried forward. These included renovating investment and labor regulations.

These efforts contributed significantly to Greece's successfully "catching two rabbits" — achieving both economic growth and restoring fiscal health. Greece's economic growth rate has consecutively surpassed the EU average over the past three years. Also, the Greek debt-to-GDP ratio, which was previously higher than 200%, fell to 168.8% in 2023, the lowest in 11 years.

With political stability and economic growth, Greece’s sovereign credit rating of non-investment grade (in 2010) was upgraded 13 years later to investment grade by S&P. Through active reforms, the incumbent party won the support of Greek citizens and formed a majority in 2023.

Spain spurs active investment and implements high-intensity labor reforms...

Improved economic fundamentals, including creation of jobs

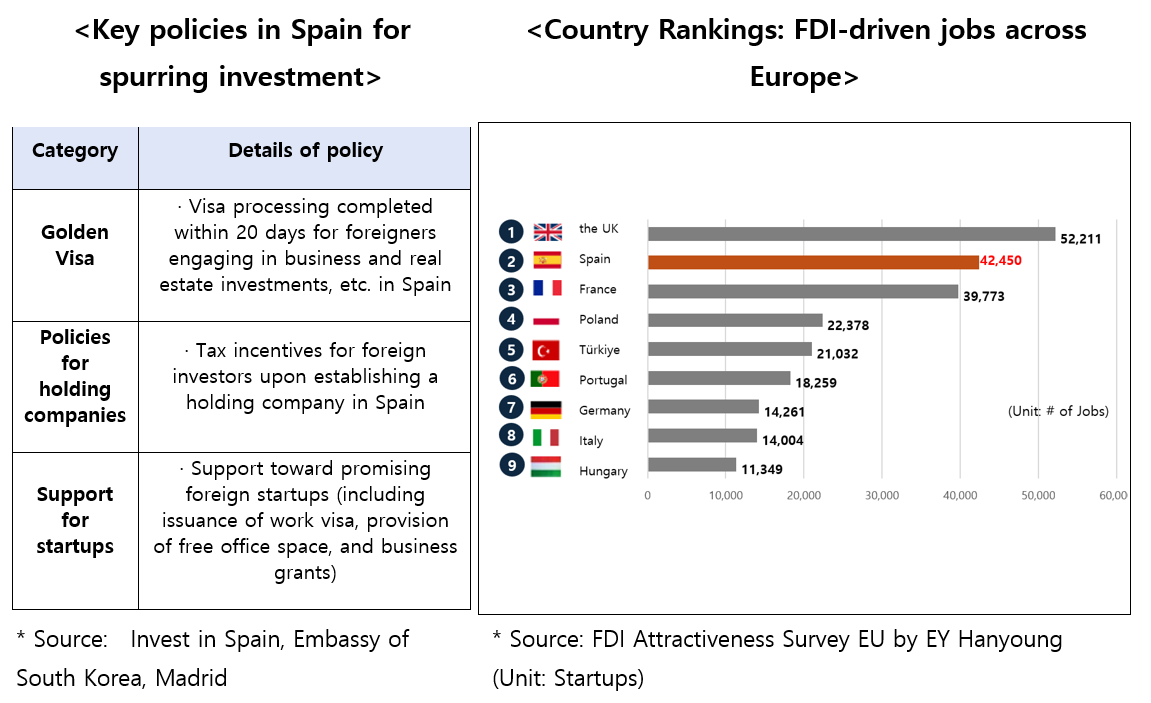

Spain was seen as a model case for overcoming the Southern European sovereign debt crisis, and excluding the impact of COVID-19, has maintained stable growth to date2). The motive force for the Spanish economic growth included all-round and high-intensity structural reforms in labor, pensions, and fiscal policy as well as active implementation of investment spurring policies.

2) Spain GDP annual growth rate 6.4% in 2021 → 5.8% in 2022 → 2.5% in 2023, IMF Outlook in 2024: 2.4%

Spain’s labor reforms included advancing labor market flexibility by streamlining requirements for employment termination and introducing short-term contractual work. Economic fundaments were improved also through measures like reducing public investments and reducing local government public deficits. Also, foreign investments were spurred through policies such as the Golden Visa program, an investment immigration policy; tax support policies for foreign investors; and fostering startups.

As a result, Spain’s chronic current account deficits turned into surplus from 2012 onward. Foreign direct investment (FDI) also performed exceptionally, recording a 169% year-over-year rise in 2021, reaching 38.31 billion dollars. Spain’s continuous promotion of FDI led to FDI-driven job creation (42,450 jobs) reaching the second-highest level in Europe in 2023, which breathed new life into the Spanish economy.

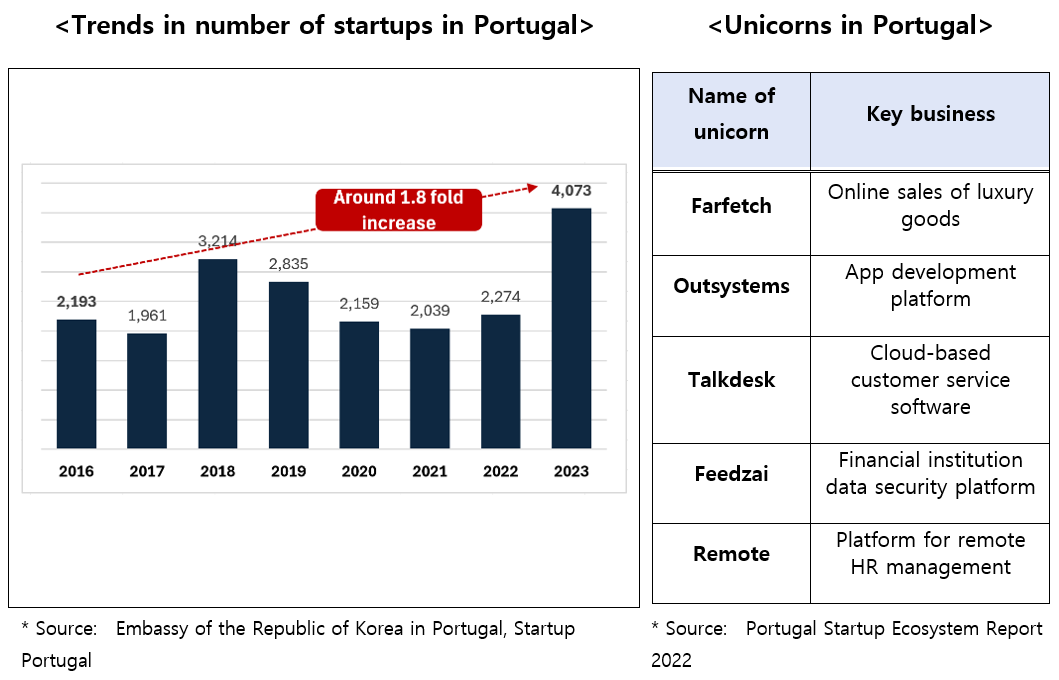

Portugal identifies future growth engines, including extensively fostering startups, through all-round and comprehensive structural reforms

Since 2011, during its sovereign debt crisis period, Portugal pursued improvements to economic fundamentals through all-round structural reforms — including in labor, taxation, and the public sector. These efforts went together with initiatives to upgrade national competitiveness, which included fostering startups and promoting foreign investment through immigration-friendly policies. Prime examples of these include Startup Portugal, a government-backed startup support program; a Golden Visa program, which confers permanent residency to foreign investors; and tax benefit programs for highly skilled foreign workers.

This contributed to the Portugal’s economic growth rate turning positive in 2015, up from -4.1% in 2012, and reaching 6.8% in 2022, one of the highest rates among EU member countries. Notable achievements include the growth in number of startups (2,193 in 2016 → 4,073 in 2023), and many of them becoming unicorns.

Bong Man Kim, vice president of the International Affairs Division of FKI, remarked, “Efforts to strengthen economic fundamentals through austerity measures, active spurring of investment, and other market-friendly initiatives were instrumental to the economic growth in Southern European countries, alongside external tailwinds from tourism’s recovery.” He added, “European economies may benefit from referring to the long-term approaches of these three Southern European countries — especially when they address structural vulnerabilities, such as responding to an anticipated period of serious slowdowns from sharp energy price hikes.”