News & Events

Press Releases

The Effects and Implications of the U.S. Clean Competition Act on the Korean Economy

|

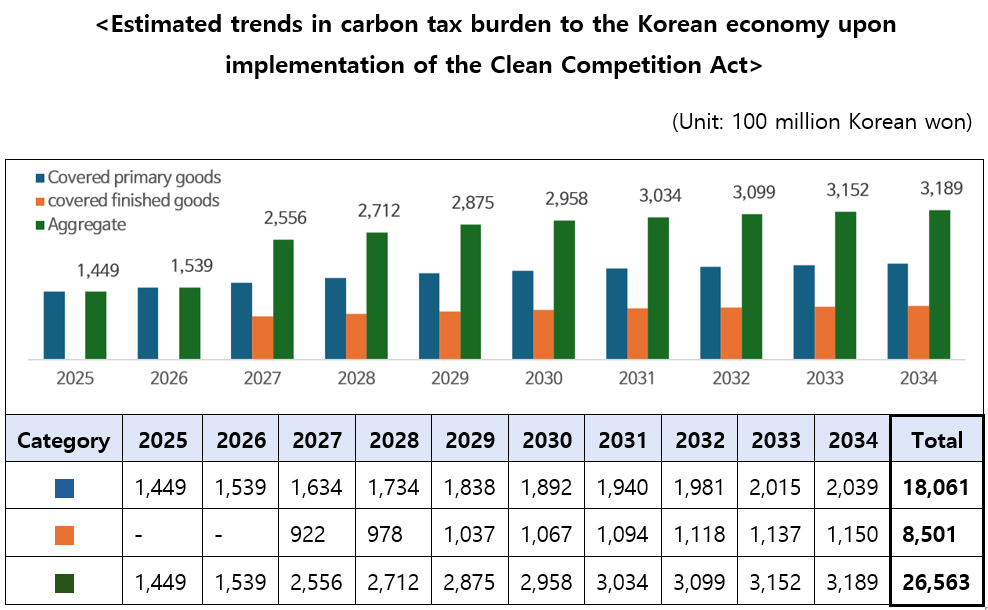

Implementation of the U.S. Clean Competition Act1) to impose a total cost of 2.7 trillion2) Korean won to the Korean economy over 10 years (2025-2034)

• [Outlook] There is bipartisan support in the U.S. for imposing carbon taxes on imports and implementation of the CCA can be anticipated in 2025

• [Cost burden by covered goods (2025-2034)] Primary goods 1.8 trillion won, finished goods* 0.9 trillion won

* Presumed covered goods: Top 10 Korean export items to the U.S.3)

• [Implications]

➀ Improve carbon intensity4) through transitioning to zero-carbon energy sources (nuclear and renewable energies)

➁ Ensure the reliability of carbon intensity data5)

➂ Based on the current operation and status of carbon pricing in Korea,6) strengthen negotiating position towards the U.S.

1) CCA (Clean Competition Act): This act would impose a carbon tax on steel, cement, and other primary goods ($55 per ton of greenhouse gas emissions). The act would cover primary goods from 2025 and would be expanded to cover finished goods after 2027.

2) Refer to Attachment 1 for method of costs estimation regarding the implementation of the Clean Competition Act

3) By HS Code: Motor vehicles (8703), Parts and accessories of motor vehicles (8708), Petroleum oils, etc. (2710), Electric storage batteries (8507), Computer parts and accessories (8473), Refrigerators, freezers, etc. (8418), Machines and mechanical appliances, etc. (8479), Solid-state non-volatile storage devices, etc. (8523), Electrical transformers, etc. (8504), Cyclic hydrocarbons, etc. (2902)

4) Carbon intensity (Carbon emissions ÷ Production output): A metric for comparing greenhouse gas emissions associated with producing like goods; may be applied to countries, industries, or products

5) When calculating the carbon tax, if reliable carbon intensity data is available from the country of origin, the charge may be determined on the carbon intensity of a covered national industry, replacing the carbon intensity of the general economy

6) The carbon clubs clause in the CCA provides that if the country of origin has implemented policies imposing explicit costs on the emission of greenhouse gases, the carbon tax (or a percentage of the charge) may be waived.

It is assessed that both the Democratic Party and the Republican Party7) of the U.S. support the imposition of carbon taxes on imports. In this regard, the CCA (which can be anticipated to be implemented in 2025) may impose a total cost burden of 2.7 trillion Korean won on the Korean economy over the next 10 years (2025-2034).

over the coming 10 years (2025-2034)

The FKI analyzed that the implementation of the CCA would impose a total carbon tax of 2.7 trillion won on the Korean economy over the next 10 years (2025-2034). In a breakdown of covered goods per category, Primary goods (■)8) and Finished goods (■)9) would incur 1.8 trillion won and 0.9 trillion won in carbon tax, respectively. Petroleum and coal products (1.1 trillion won) and Chemical manufacturing (0.6 trillion won) are expected to feel the biggest impact, according to an estimation per covered national industry.

There is bipartisan support in the U.S. for carbon taxes, and the CCA can be anticipated to be implemented from 2025 onward

The Clean Competition Act was initially proposed by the Democratic Party in June 2022 to address issues of production cost disparities and price competitiveness decline stemming from differences in carbon intensity across countries. Senator Sheldon Whitehouse (D-RI) and Congresswoman Suzan DelBene (D-WA) have re-introduced legislation of the Clean Competition Act in December 2023, and it is assessed that both the Democratic Party and the Republican Party support imposing carbon taxes on imports.

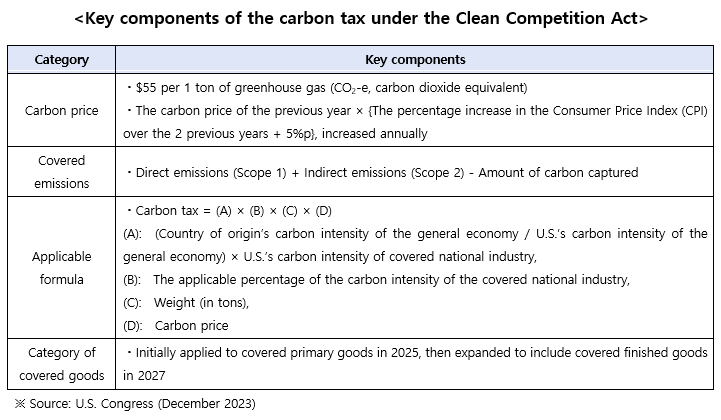

With the implementation of the CCA, a carbon tax would be imposed amounting to the quotient of carbon intensity of the general economy of the U.S. divided by that of the country of origin, multiplied by the carbon price. The carbon price would be raised annually in consideration of the Consumer Price Index.

For example, if a Korean company were to export covered primary goods to the U.S., the importer in the U.S. would be charged with a carbon tax according to the CCA. In this case, the importer would pass on the carbon tax costs to the exporting Korean company, and the carbon tax would act as a cost burden.

The carbon tax would be determined by multiplying the following: the quotient of the carbon intensity of the general economy of the U.S. divided by that of South Korea; the carbon price; the applicable carbon intensity percentage of the covered national industry; and the total weight of the covered goods.

Assuming a carbon intensity ratio of 1 between the general economies of the U.S. and Korea; a carbon price of $55 per ton; and an applicable carbon intensity ratio for the covered national industry of 1; then, a Korean exporter exporting a total of 100 tons to the U.S. would be imposed a cost increase of $5,500.

The carbon tax would initially be applied to covered primary goods under the 26 energy intensive industries from 2025, then be expanded to include covered finished goods.

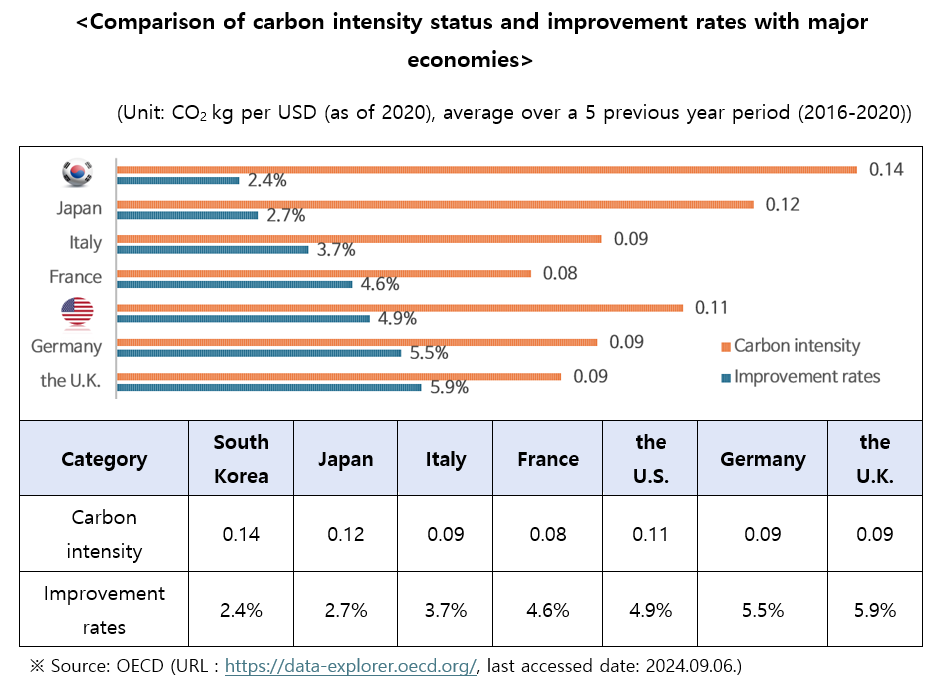

Korea falls 2.5%p short in carbon intensity improvement rate

The 3 policy implications for reducing carbon tax costs due to the CCA

The FKI recommends taking actions such as converting to zero-carbon energy sources in the power generation sector to make carbon intensity improvements. Such actions would be necessary for businesses to reduce carbon tax burdens.

[①Transition to zero-carbon energy sources in the power generation sector]

The carbon taxes imposed by the CCA is based on the difference between the carbon intensities of countries (the general economy)10). The transition to zero-carbon energy sources in the power generation sector is a known prerequisite for electrification11), a key decarbonization strategy for various industries, including manufacturing, construction, and transportation. A scenario analysis indicates that when improvements are made to the carbon intensity of the general economy, there is an estimated burden reductions benefit of 4.9% (approx. 8.8 billion won) against the U.S. carbon tax (imposed by the CCA) when a 1% annual improvement is made to the carbon intensity of the general economy.

10) The carbon intensity of the general economy = Total greenhouse gas emissions ÷ Gross Domestic Product (GDP)

11) Electrification : The transitioning of energy sources from fuel and raw materials to electricity - this includes industries such as hydrogen-based steelmaking, utilization of heat pumps in buildings, and electric transport vehicles.

[②Ensure the reliability of data and take a leadership role in international consultative groups on the government level]

The CCA provides for the possibility that carbon tax calculations may be affected by a country of origin’s data reliability of carbon intensity of a covered national industry. The Inclusive Forum on Carbon Mitigation Approaches (IFCMA), which was launched under the leadership of the Organisation for Economic Co-operation and Development (OECD), performs research on carbon intensity and the effects of greenhouse gas emissions reductions. The results of these studies are expected to materially affect carbon tax calculations in not only the E.U.’s Carbon Border Adjustment Mechanism (CBAM), but also in the Clean Competition Act. Taking a leadership role in this forum, the Korean government would need to take necessary measures so that the country’s carbon intensity improvements in covered national industries may be reflected toward lowering carbon tax burdens.

[③Strengthen negotiating position toward the U.S.]

The carbon clubs clause in the CCA provides that if the country of origin has implemented policies imposing explicit costs on the emission of greenhouse gases, the carbon tax (or a percentage of the charge) may be waived. The Korean government needs to proactively secure negotiating power toward the U.S. based on the current operations and trends in carbon pricing in Korea12), such as the upward trends in the share of auctioning in the Emissions Trading System (ETS) and the current state of carbon price13).

12) Korea’s Effective Carbon Rates stand at 29.9EUR/tCO2, compared to 12.0EUR/tCO2 for the U.S. (both as of 2021). This means that Korea is imposing a carbon price that is approximately 2.5-fold higher than the U.S.

13) Carbon pricing : Carbon pricing includes measures that impose a cost on carbon emissions. They are regulatory measure which targets emitters by introducing an externality burden on greenhouse gas emissions. Well-known carbon pricing mechanisms include emissions trading systems and carbon taxes.