News & Events

Press Releases

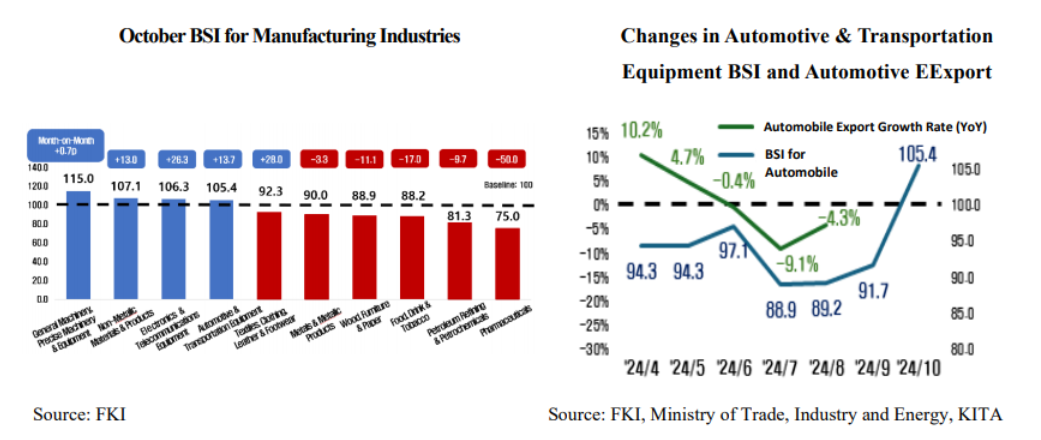

October Business Survey Index (BSI) Released

|

Sluggishness Continued, with October BSI Hitting 96.2

Domestic Demand Down; Export Up

(MoM, September BSI 92.9)

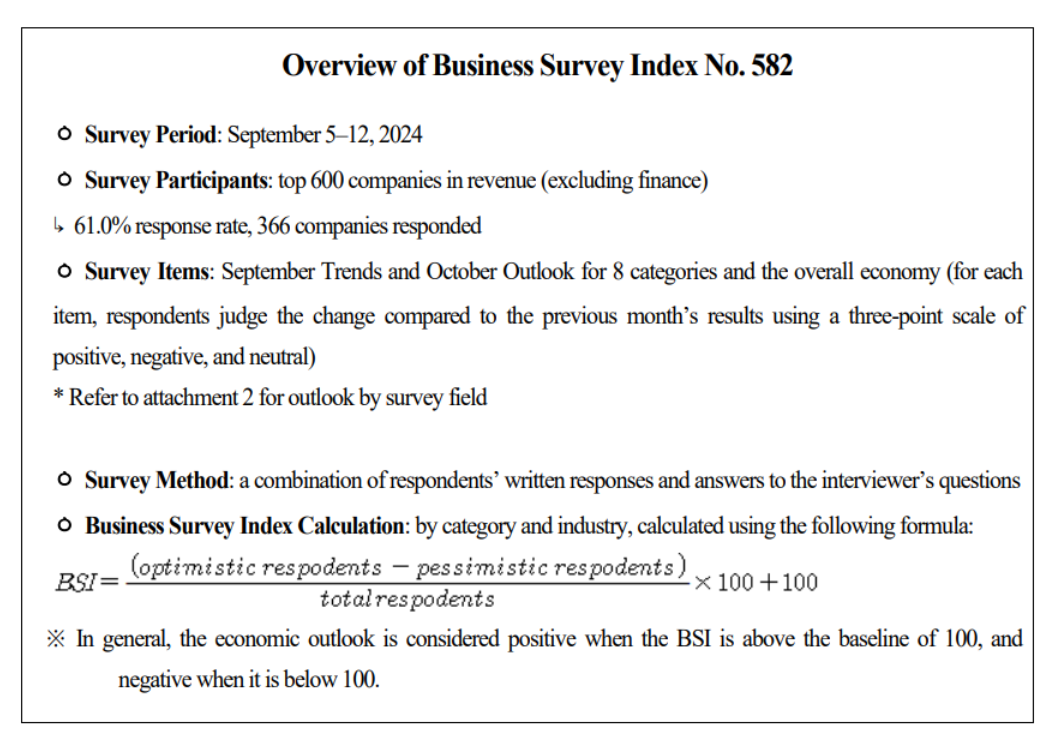

• Overall BSI outlook (96.2) continued its sluggish results for 31 months since April 2022.

* October BSI rose 3.3p MoM (September BSI 92.9 → October BSI 96.2)

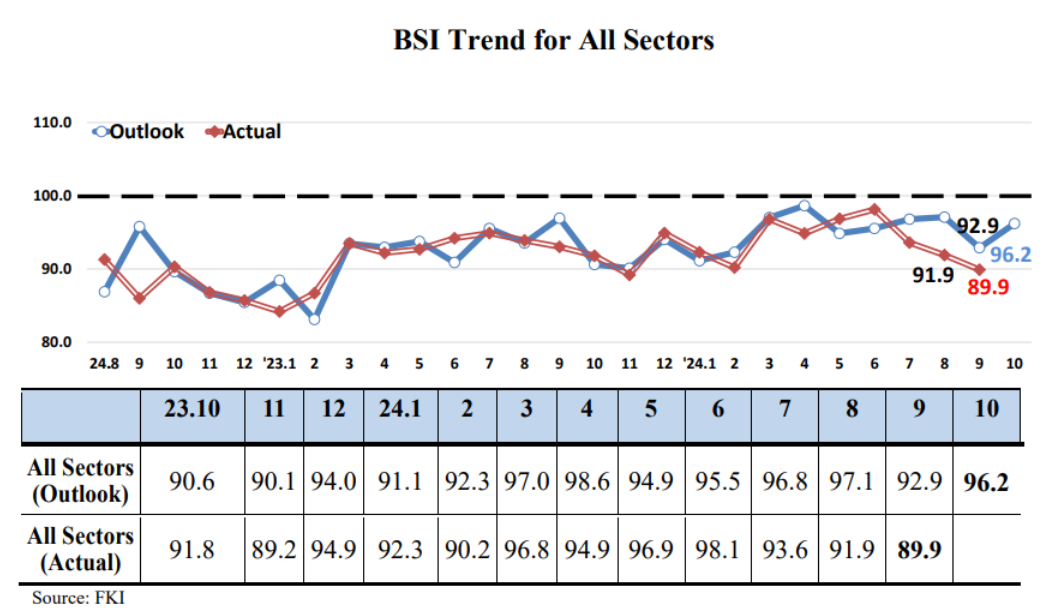

• [BSI by Sector] Both the manufacturing (96.4) and non-manufacturing (96.0) sectors have been sluggish for 3 months

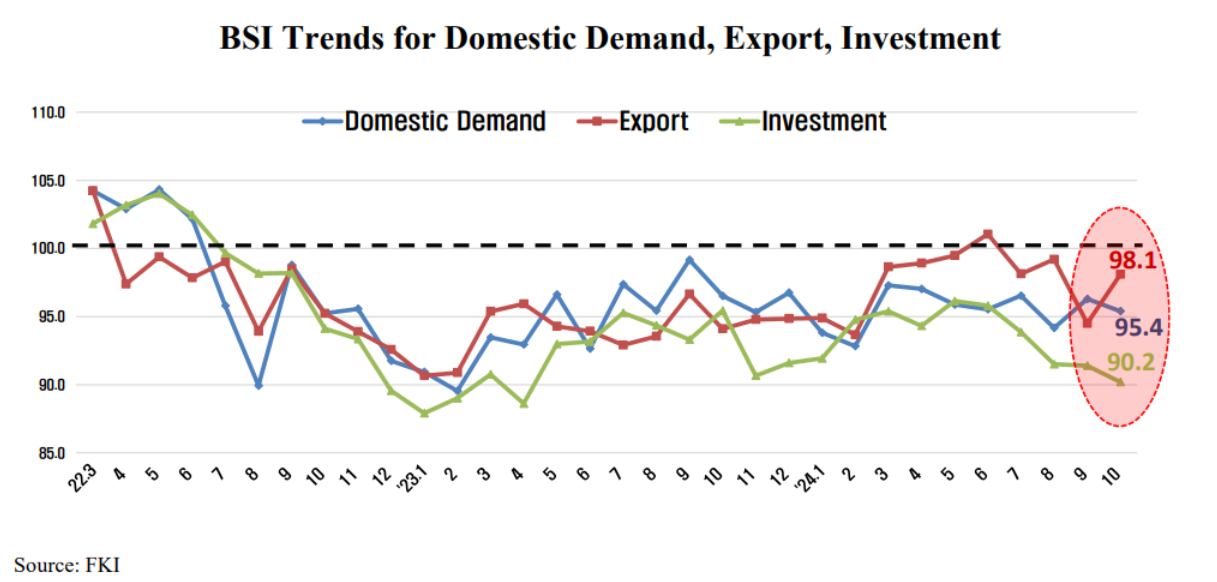

• [BSI by Survey Field] Domestic demand (95.4), Export (98.1), investment (90.2) have dropped for 4 months

* Domestic demand fell (September 96.3 → October 95.4) while Export rose (September 94.5 → October 98.1)

* Investment (90.2) hit its lowest point in 18 months since the dip in April 2023 (88.6)

• Domestic demand and investment need to be stimulated by stabilizing interest rates and easing regulations (Corporate governance regulation, etc.)

The Federation of Korean Industries (FKI)’s Business Survey Index (BSI), a survey of the business sentiment of the largest 600 Korean companies in revenue, recorded an outlook of 96.2 for October, falling short of the baseline of 1001). It was up 3.3 points from the previous month (92.9), but has remained under the baseline for 31 months.

1) If the BSI is over 100, business sentiment is more positive about the economy than the previous month and vice versa.

The manufacturing sector (96.4) and non-manufacturing sector (96.0) both reported grim business outlooks for October. The former2), which had surpassed the baseline (100) in March of this year (100.5), slipped below the baseline in April (98.4) and has remained there for 7 consecutive months. The non-manufacturing sector3)(91.9), which had surpassed the baseline (100) in July (105.5), has failed to reach the baseline for the past three months.

2) Manufacturing Industry BSI Outlook: 100.5 (Mar., ’24), 98.4 (Apr.), 95.5 (May), 95.9 (Jun.), 88.5 (Jul.), 94.8 (Aug.), 93.9 (Sept.), 96.4 (Oct.)

3) Non-Manufacturing Industry BSI Outlook: 105.5 (Jul.), 99.5 (Aug.), 91.9 (Sept.), 96.0 (Oct.)

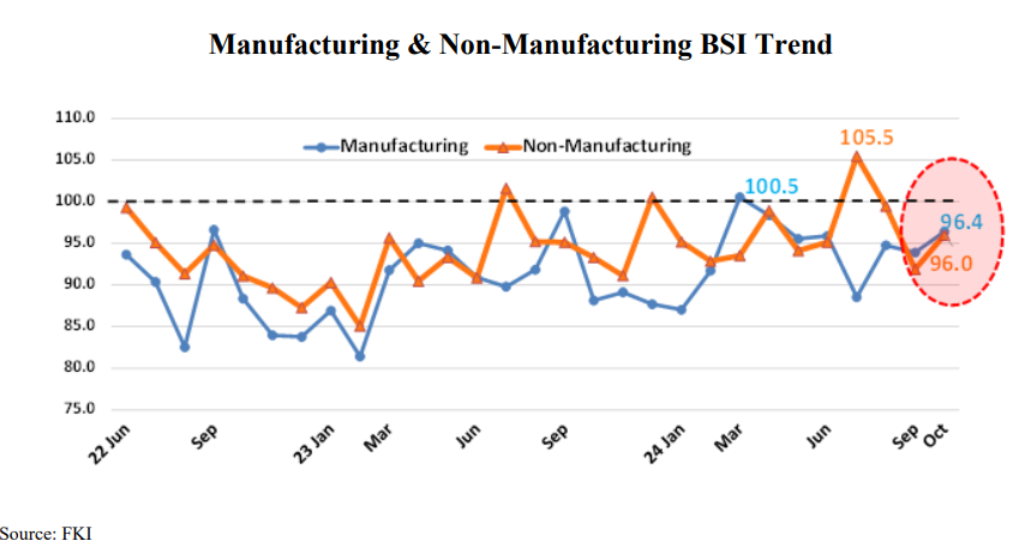

The FKI stated, “Semiconductor Export is expected to be strong5) with the two industries showing promising prospects: Electronics & Telecommunications Equipment (106.3), which includes semiconductors, and General Machinery, Precision Machinery & Equipment (115.0), which includes parts for semiconductors.”

5) Semiconductor export changes (Ministry of Trade, Industry and Energy·KITA, MoM, %): 56.2 (Jan., ‘24) → 66.7 (Feb.) → 35.7 (Mar.) → 56.1 (Apr.) → 54.4 (May) → 50.9 (Jun.) → 50.2 (Jul.) → 38.8 (Aug.)

“Automotive Export is expected to bounce back, as Automotive & Transportation Equipment (105.4) crossed the baseline6) for the first time in 7 months.”7)

6) Automotive & Transportation Equipment BSI (Ministry of Trade, Industry and Energy·KITA, MoM, %): 110.0 (Mar., ‘24) → 94.3 (Apr.) → 94.3 (May) → 97.1 (Jun.) → 88.9 (Jul.) → 89.2 (Aug.) → 91.7 (Sept.) → 105.4 (Oct.)

7) Changes in automotive export (Ministry of Trade, Industry and Energy·KITA, MoM, %) : 56.2 (Jan., ‘24) → 66.7 (Feb.) → 35.7 (Mar.) → 56.1 (Apr.) → 54.4 (May) → 50.9 (Jun.) → 50.2 (Jul.) → 38.8 (Aug.)

However, continued high interest rates and shrinking domestic demand8) are signs of a challenging time ahead for other industries.

8) Manufacturing domestic supply index (Ministry of Statistics, MoM): 1.8% ('22) → -1.2% ('23) → -2.4% (1Q24) → -2.3% (2Q24) → 2.7% (Jul., '24)

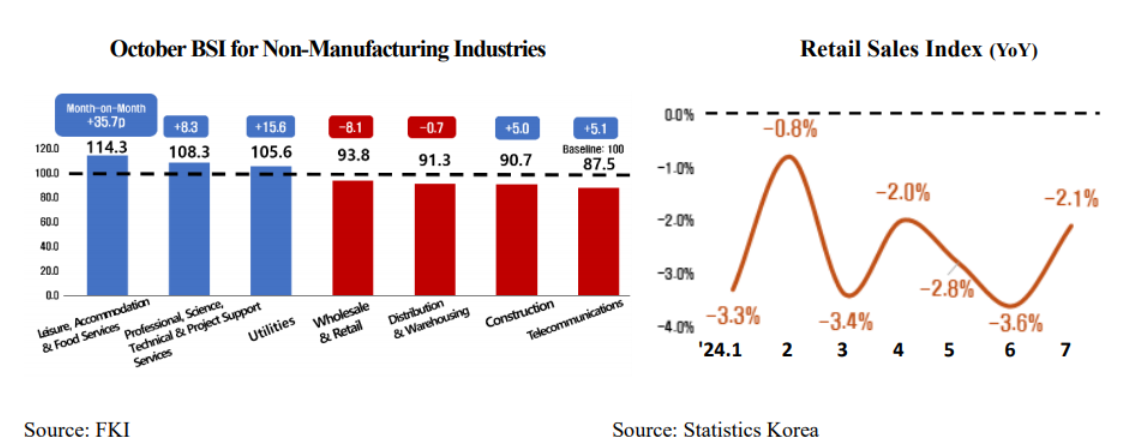

In the non-manufacturing sector (7 in total), Leisure, Accommodations & Food Services (114.3), Professional, Science, Technical & Project Support Services (108.3), and Utilities (105.6) showed a positive outlook, while the remaining four industries all continue to share weak expectations for the time being9).

9) Telecommunications (87.5) ▸Construction (90.7) ▸Distribution & Warehousing (91.3) ▸Wholesale & Retail (93.8)

The FKI commented, “the October BSI for non-manufacturing industries failed to reach the baseline with the ongoing10) slump in Construction and weak domestic demand,11) despite the good performance of Leisure, Accommodations & Food Services (114.3).

10) Changes in the number of workers with employment insurance (Construction Industry, Ministry of labor, YoY, Unit: 1,000): △2 (Jan., ’24) → △4 (Feb.)→ △6(Mar)→ △7 (Apr.)→ △8 (May)→ △10 (Jun.)→ △12 (Jul.)→ △13 (Aug.)

11) Retail sales index (Statistics Korea, YoY, Invariant, %): △3.3% (Jan., ’24)→ △0.8% (Feb.)→ △3.4% (Mar.)→ △2.0% (Apr.)→ △2.8% (May)→ △3.6% (Jun.)→ △2.1% (Jul.)

The October BSI indicates a business downturn across all industries [Export (98.1), profitability (95.9), employment (95.6), domestic demand (95.4), funds (94.0), investment (90.2) and inventories (103.0)12)]

12) If inventory surpasses the baseline (100), it casts the negative outlook (overstock)

Although Export (98.1) didn’t reach the baseline, they rose 3.6 points compared to the previous month (94.5), while domestic demand (95.4) dropped 0.9 points from September (96.3). Investment (90.2) hit the lowest point in 18 months, since April 2023 (88.6). Therefore, the sluggishness in domestic demand, Export, and investment continued for the fourth consecutive month since the July outlook this year. Notably domestic demand (96.3), export (94.5), and investment (91.4) have remained lackluster for the three months following the July outlook. Domestic demand (96.3) has been under the baseline since July 2022 (95.8), 27 months in a row, as the pressure from high interest rates has pushed households to delay spending.

The FKI stated, “Domestic demand and investment continue their weak performance as internal and external uncertainties such as the U.S. election, and expansion of prolonged geopolitical clashes, while investment and domestic demand capacity have decreased with the household·corporate loan delinquency rate now showing trends13), 14) similar to those during the COVID-19 period.15)

13) Corporate loan delinquency rate (raw data: Financial Supervisory Service, calculated by FKI, %): 0.49 (1Q20) → 0.37 (1Q21) → 0.26 (1Q22) → 0.37 (1Q23) → 0.48 (1Q24)

14) Domestic loan delinquency rate (raw data: Financial Supervisory Service, calculated by FKI, %): 0.27 (1Q20) → 0.18 (1Q21) → 0.17 (1Q22) → 0.31 (1Q23) → 0.37 (1Q24)

15) Domestic demand (BoK, QoQ, %) : 0.1 (3Q23) → 0.4 (4Q) → 0.7 (1Q24) → △0.2 (2Q)

Facilities investment (BoK, QoQ, %) : △2.0 (3Q23) → 2.8 (4Q) → △2.0 (1Q24) → △1.2 (2Q)

Construction investment (BoK, QoQ, %) : 1.9 (3Q23) → △3.8 (4Q) → 3.3 (1Q24) → △1.7 (2Q)

“Economic recovery in the fourth quarter is uncertain as the slowdown in domestic demand continues with declining consumption despite the recent surge in Export,”16) said Sang-ho Lee, vice president of the FKI’s Economic and Industrial Research Department.

16) Changes in exports (Ministry of Trade, Industry and Energy, MoM): 11.5% (May, ’24) → 5.6% (Jun.) → 13.9% (Jul.) → 11.4% (Aug.)

To revitalize domestic demand and investment, interest rates should be stabilized, and the legislation and amendment of laws that may aggravate the situation should be curtailed, such as the revision of Commercial Act (e.g., Expand the scope of fiduciary duties, mandatory cumulative voting).”