News & Events

Press Releases

August Business Survey Index (BSI) Released

|

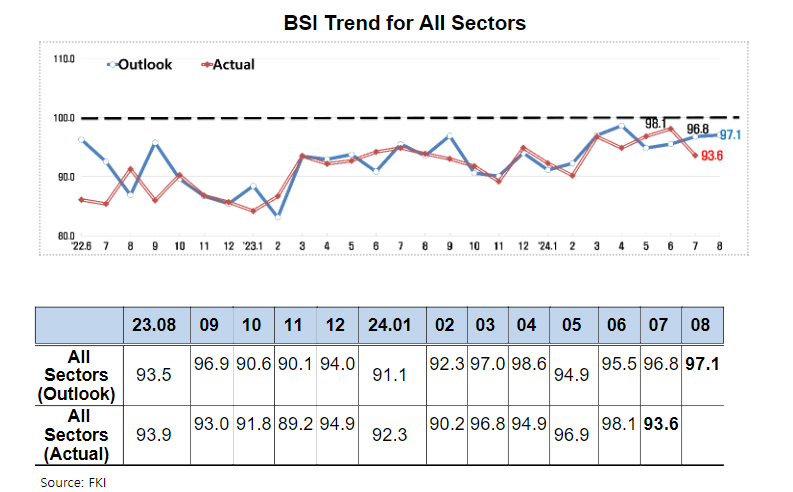

Korea’s Business Sentiment Remains Poor and August BSI Continues to Dip (97.1)

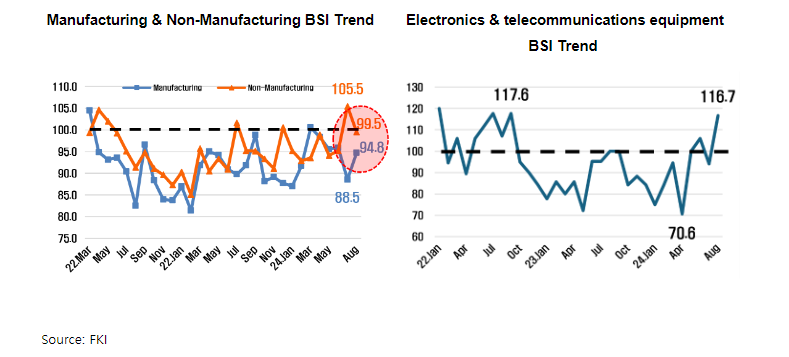

• Overall BSI outlook (97.1) remains negative for 29 months straight since April 2022 (99.1)

• The manufacturing sector index (94.8) rose 6.3 points compared to the previous month (88.5).

* Electronics/Telecommunications equipment including semiconductors

(116.7) hit the maximum after 23 months since September 2022 (117.6).

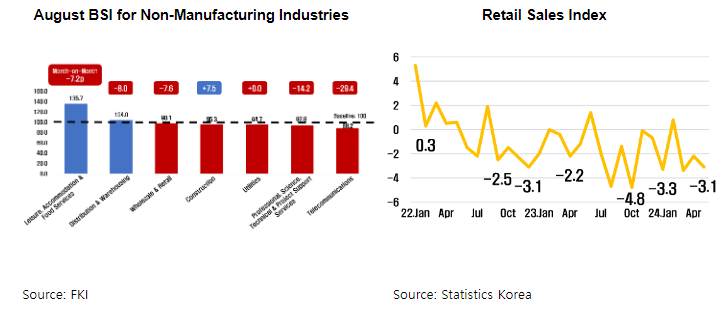

• The outlook for the non-manufacturing sector turned negative(95.2 (June) → 105.5 (July)) again only one month after the release of a positive outlook.

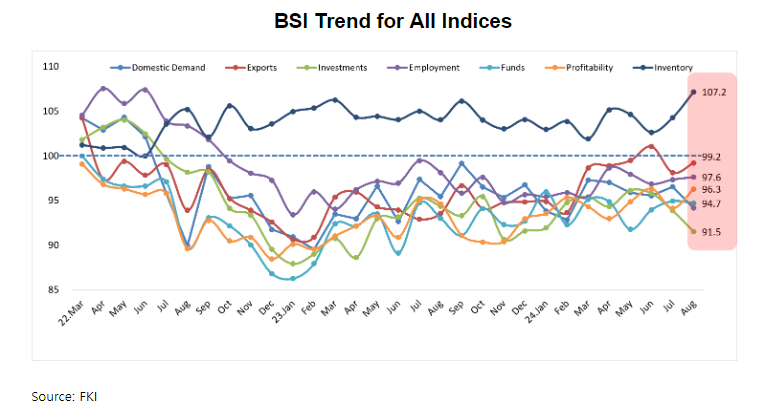

• All industries subject to the survey showed a sluggish performance for 2 months.

* Domestic demand (94.2), Export (99.2), Investment (91.5), Employment (97.6), Financial condition (94.7), Profitability (96.3), and Inventory (107.2).

* Inventory for the manufacturing sector (112.0) hit its record high after 4 years and 1 month since July 2020 (112.9).

• Renovation of the tax system and easing of regulations (Trade Union and Labor Relations Adjustment Act, etc.) are deemed necessary.

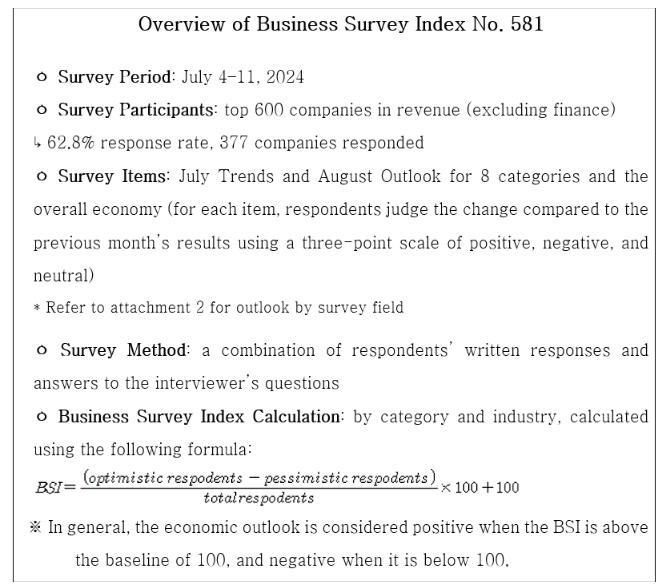

The Federation of Korean Industries (FKI)’s Business Survey Index (BSI), a survey of the business sentiment of the largest 600 Korean companies in revenue, recorded an outlook for August of 97.1, falling short of the baseline of 100 1 . This means the BSI has now been negative for 29 months straight since April 2022 (99.1).

1 If the BSI is over 100, business sentiment is more positive about the economy than the previous month and vice versa.

The actual BSI for July was 93.6, which is the 30th negative result since February 2022 (91.5), indicating that sluggish business performance continues.

The manufacturing sector (94.8) and non-manufacturing sector (99.5) both reported grim business outlooks for August. The former rebounded 6.3 points compared to the previous month (88.5) thanks to a rise in the semiconductor industry 2 . However, as concerns over weak domestic demand persisted, the manufacturing sector failed to reach the baseline and emerge from its slump 3 4 . Manufacturing industry continues to slump for 5 months since April (98.4) 5 . The non-manufacturing sector, which had surpassed 6 the baseline (100) for the first time this year, fell short of it again in a month.

2 Electronics/Telecommunications equipment including semiconductors BSI Outlook : 100.0(May) → 105.9(June) → 94.1(July) → 116.7(August)

3 Retail Sales (Statistics Korea; YoY) : 0.8%(February) → -3.4%(March) → -2.2%(April) → -3.1%(May)

4 Equipment Investment (Statistics Korea; YoY) : -0.8%(February) → -4.4%(March)→ -2.2%(April) → -5.1%(May)

5 Manufacturing Industry BSI Outlook : 100.5(March), 98.4(April), 95.5(May), 95.9(June), 88.5(July), 94.8(August)

6 Non-Manufacturing Industry BSI Outlook : 93.5(March), 98.9(April), 94.1(May), 95.2(June), 105.5(July), 95.5(August)

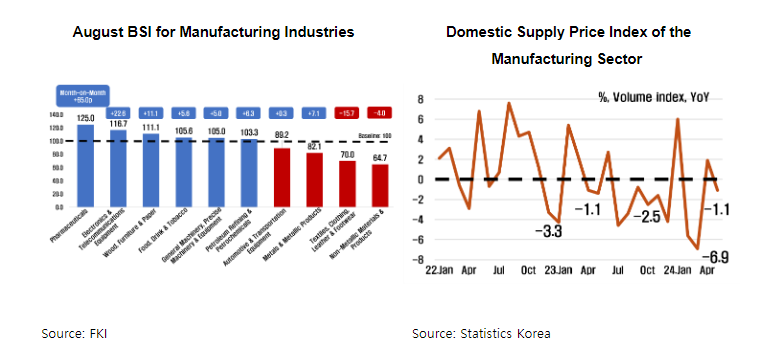

The August outlooks for the manufacturing sector varied drastically by industry (Total 10). Pharmaceuticals (125.0), Electronics & telecommunications equipment (116.7), Wood, furniture and paper (111.1), Food, beverage and Tobacco (105.6), General machinery, precision machinery and equipment (105.0), and Petroleum refining and petrochemicals (103.3) all demonstrated a positive outlook, while the expectations for the rest 4 industries 7 remained lower than 90 (Baseline: 100), further driving the negative business sentiment for the entire manufacturing sector.

7 Non-metals and related products (64.7), Textile/Clothing and Leather/Shoes (70.0), Metals and related products (82.1), Automobile and other transportation equipment (89.2)

The FKI attributed this to rising fear over demand contraction due to the prolonged high interest rate policy 8 , etc., despite some improvement in business sentiment mainly in Electronics & telecommunications equipment (116.7) resulting from the recent boom in semiconductor exports.

8 Domestic Supply Price Index of the Manufacturing Sector : 1.8%(2022) → -1.2%(2023) → -2.4%(24.1Q) → 1.9%(April) → -1.1%(May)

In the non-manufacturing sector (Total 7), the Leisure, accommodation & food services (135.7), distribution and warehousing (104.0) industries are expected to see an uptick on the back of vacation season demand. However, the other five industries 9 including wholesale and retail (98.1), which have been suffering from a consumption slowdown 10 , and the construction industry (95.3) that is experiencing dwindling orders 11 are all anticipated to take a downturn and fall short of the baseline (100).

9 Telecommunications (88.2), Professional, science, technical & project support services (92.9) Electricity/Gas/Water supply (94.7), Construction (95.3), Wholesale/Retail (98.1)

10 Retail Sales Index (Statistics Korea; YoY) : -0.3%(2022) → -1.5%(2023) → -2.1%(24.1Q) → -2.2%(April) → -3.1%(May)

11 Construction Orders Received (Statistics Korea; YoY) : 10.0%(2022) → -18.5%(2023) → -15.6%(24.1Q) → 50.6%(April) → -35.4%(May)