News & Events

Press Releases

Survey of Large Companies’ 2H2024 Investment Plans

|

90.9% of Large Companies to Maintain or Increase Their Investments in the Second Half of 2024 (Maintain 74.2%, Increase 16.7%)

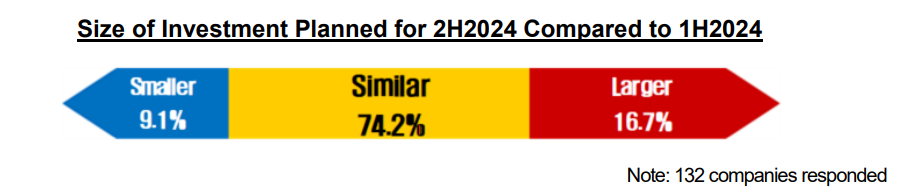

• Comparison of 2H Investment Plans to 1H: similar level – 74.2%, larger - 16.7%, smaller - 9.1%

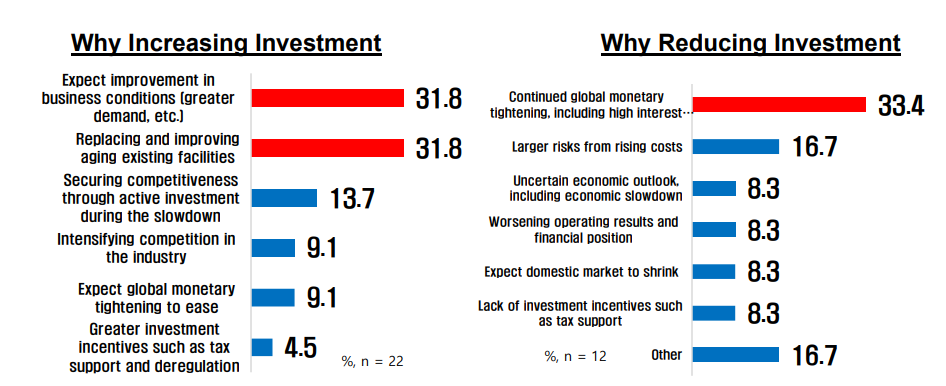

• AI Investment Plans: More than 4 out of every 10 companies (43.9%) have established or are considering an AI-specific investment plan

* Reasons for AI Investment Plan: increase productivity - 46.6% > new products and improve services - 29.3% > establish strategies - 13.8%

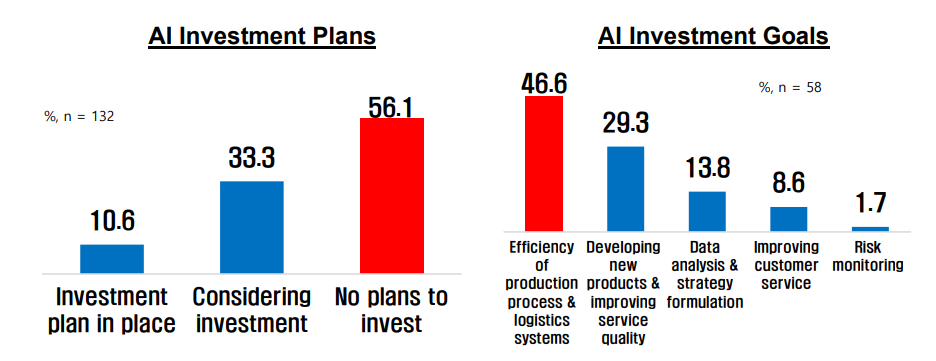

• Main Investment Risks: high interest rates – 28.0%, strong dollar – 21.2%, economic uncertainty – 16.7%

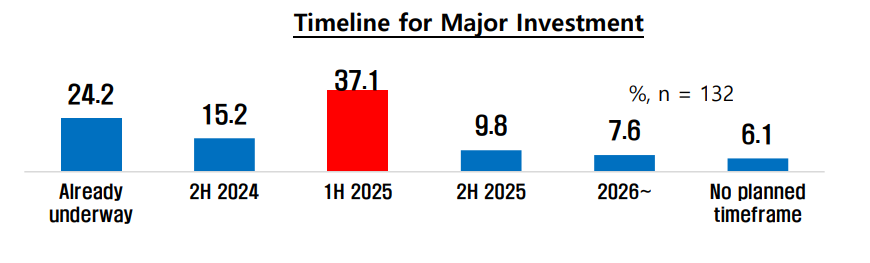

• Timeline for Investment: H1 2025 – 37.1%, already underway - 24.2%, H2 2024 – 15.2%

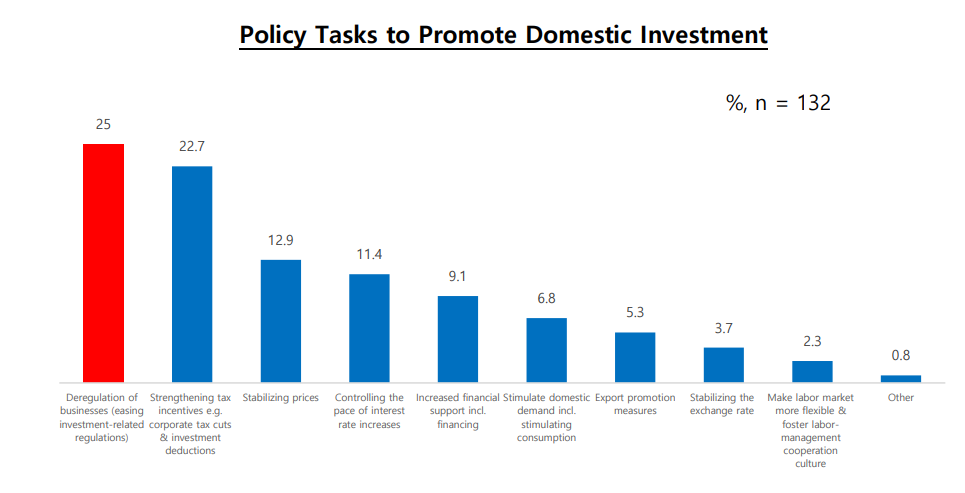

• Tasks for Promoting Investment: ① reduce investment regulation ② tax support e.g. investment tax credits ③ reduce inflation

Despite fears that high interest rates and a weak won to the U.S. dollar will not abate soon and an uncertain international environment, according to a survey, three out of every four large Korean companies will maintain their level of investment in the second half of 2024. With more companies responding that they will increase their investment in 2H24 then those saying they will decrease investment, private investment is expected to improve in the second half of the year.

2H Investment Plans Compared to 1H: Similar - 74.2%, Larger - 16.7%, Smaller - 9.1%

The Federation of Korean Industries (FKI) commissioned Mono Research to survey the top 500 Korean companies in terms of revenue (132 respondents) on their investment plans for 2H2024. Most companies responded that their investments for 2H will be similar to those in 1H (74.2%), followed by 16.7% saying they will increase their investment, and 9.1% responding that they will reduce their investment.

Of the companies who responded they are going to invest more in 2H, the top reasons given were investing in replacing/upgrading their aging facilities (31.8%), expectations that their business sector is going to improve (31.8%), and to gain a competitive edge by investing aggressively during a sluggish period (13.7%).

On the other hand, companies that plan to reduce investment cited expectations of continued global monetary tightening, including high interest rates (33.4%), and expanding risks due to rising costs (16.7%) as the reasons for reducing investment.

The FKI explained that although companies are concerned about the continuation of monetary tightening, including high interest rates, many companies are planning to maintain or increase their investment compared to 1H due to high expectations that the economy will improve, including increased global demand.

More than 4 out of every 10 companies (43.9%) are planning to or are considering investing in AI

Goals for AI investment: increase productivity - 46.6% > develop new products - 29.3% > analyze data - 13.8%

Four of every ten companies (43.9%) were shown to be planning (10.6%) or considering (33.3%) making AI investments. The top reason given for AI-related investments was to streamline production processes and logistics systems (46.6%). This was followed by new product development & service quality improvement (29.3%) and data analysis & formulating strategies (13.8%).

Major investment risks: ① high interest rates (28.0%), ② strong dollar (21.2%), ③ uncertain economic outlook (16.7%)

Companies cited continued high interest rates due to global monetary tightening (28.0%) as the biggest risk to investment activity in 2H, followed by the strong dollar (21.2%) and an uncertain economic outlook (16.7%), including the possibility of an economic slowdown.

Timeline for major investment: 1H25 - 37.1% > already underway- 24.2% > 2H24 - 15.2%

Regarding when they expect to invest heavily, four out of 10 respondents (37.1%) said 1H2025, while 24.2% said they are already investing heavily, and 15.2% said 2H2024.

The FKI observed that while the second half of this year is expected to be a period of slowing 1 growth due to global monetary tightening, next year is expected to be a period of global economic recovery 2, with stabilization of major indicators such as interest rates and inflation, so companies are looking to invest more next year.

1 Korea Economic Outlook 2024 (Bank of Korea): 1H - 2.9%, 2H - 2.2%

2 World Economic Outlook (OECD): 2024 – 3.1%, 2025 – 3.2%

Reduce businesses’ regulatory burden and strengthen tax incentives to improve domestic investment climate

Companies most frequently cited reducing business regulations such as investment-related regulations (25.0%) as the main policy issue to improve the domestic investment climate. This was followed by strengthening tax support such as corporate tax cuts and investment tax credits (22.7%) and reducing inflation (12.9%).

"The business environment is currently very difficult for companies, with prolonged high interest rates and a weak won to the dollar affecting their financial positions 3," said Sang-ho Lee, vice president of the FKI’s Economic and Industrial Research Department. "We need to increase tax support 4 and reduce regulation 5 to help companies unleash their investment capacity while inducing investment in future industries through R&D incentives 6."