Super Weak Yen Expected to Gradually Improve

FKI invites Tsutomu Watanabe, University of Tokyo Professor and Former Senior Economist at the Bank of Japan

• Causes of Weak Yen: ① Quantitative Easing ② Large interest rate gap between Japan and the U.S.

* Base interest rates: (June 2024): U.S. – 5.55%, Japan – 0.10%, 5.45%p gap

• Outlook: The yen is expected to recover as the Japanese economy normalizes, however the recovery will be restricted by the national debt burden

* Japan’s national debt to GDP ratio (as of late 2023): 252% → reluctant to raise interest rates as national debt interest payments would rise too

• Effect on Korea: Worries that a strong won and weak yen would cause Korean companies’ operating profits to fall

* However, if Japan raises interest rates → gap between Korea and Japan interest rates falls → settlement of yen carry trades could occur

• Measures: Increase Support (e.g. R&D support) for export items with high similarity to Japanese exports to reduce the effect 1 of the super weak yen

1 Yen carry trade: Refers to borrowing yen as Japan has minus interest rates to buy another currency with higher exchange rates. Such trades equal around $20 trillion globally (as of late 2023) according to Deutsche Bank.

As the weak yen trend 2 continues unabated, the Federation of Korean Industries (FKI), held the second 3 of its Global Zoom Seminars, titled “Outlook and Measures for the Crashing Yen” on July 2 at the FKI Tower Conference Center in Yeouido. At the seminar, the causes for the weak yen, the outlook for the yen going forward, and what measures should be taken to protect the Korean economy against any effects of the weak yen were discussed.

2 JPY/USD average FX rate: 145.98 (Jan. 2024) 149.46 (Feb.) 149.67 (March) 153.70 (April) 155.90 (May) 157.86 (June)

3 Global Zoom Seminar I: Global Economic Turbulence (April 30)

As a weak Japanese yen can have a negative impact on the Korean economy, we must pay close attention to how it develops,” said FKI Vice Chairman Chang-beom Kim in his opening remarks. “While the export similarity 4 between Korea and Japan has fallen, Japan is still the biggest competitor 5 for Korea in the global market, which means we must make sure we have some financial and industrial measures in place to prepare against a potential long-term weak Yen.”

4 Korea-Japan Export Similarity (Index of All Industry Production, KITA): 2012 - 0.481 2017 - 0.463 2022 -- 0.458. The closer the export similarity index is to 1, the more similar the countries’ export structures are and the more similar their exports are.

5 Other Export Similarity Indexes (Manufacturing Sector 2020, FKI): Korea-Japan (0.692), Korea-U.S. (0.685), Korea-China (0.560), Korea-UK (0.557), Korea-France (0.552)

Diagnosis of Japanese Economy: Overcame Deflation and on the Way to Normalizing

Former Bank of Japan Senior Economist Tsutomu Watanabe, who currently teaches at the University of Tokyo, gave the keynote speech at the seminar, titled “The Causes of the Weak Yen and Outlook”. “The drop in the yen’s value can be attributed to sticky consumer prices and wages in Japan and the differences in Japanese and American monetary policy (Expansionary vs Tightening),” said Watanabe during his keynote. “Japan’s prices and wages have been basically the same for over 20 years, and because of deflation, businesses have not been able to easily pass on increases in production costs to consumers.”

Professor Watanabe explained the recent developments in the Japanese economy, saying “As consumer prices and wages 6 began normalizing in the spring of 2022 and remained steady at the start of this year, the Bank of Japan was able to move away from expansionary monetary policy and bring the base rate into the positive in March”.

6 2024 Shunto (Spring Wage Offensive – Collective Bargaining Negotiations): Average increase in wages is 5.25% (the highest in 30 years)

“The Bank of Japan will raise interest rates further when it is certain that consumer prices and wages will keep rising, and will start to reduce national debt,” said Professor Watanabe. “If that happens, we should see the yen grow stronger.”

Weak Yen Outlook: Can only raise interest rates so much due to national debt interest repayments. Not easy to fix weak yen

Young Sik Jeong, Executive Director of the Department of International Macroeconomics and Finance at the Korea Institute for International Economic Policy (KIEP), and Bobby Byun, Group Head of the Seoul Treasury Dealing Room at the Seoul Branch of Mizuho Bank participated in a panel discussion during the seminar. The two financial experts pointed out how Abenomics such as overzealous expansionary policy has caused excessive national debt 7 while doubting 8 if Japan has the ability to pay the interest repayments if the base interest is raised and forecast that unless the U.S. Fed institutes substantial interest rate cuts, the difference in the interest rates in Japan and the U.S. will mean that Japanese interest rate rises and the recovery of the yen’s value will be limited.

7 Japanese national debt to GDP ratio (late 2023): 252%

8 Japanese national debt principal and interest repayments are approaching 30% of annual expenditure (late 2023)

“The difference between U.S and Japanese interest rates has some blame for the weak yen, but the past expansionary policies of Japan had a greater effect,” said Executive Director Jeong. “Japan currently has a current account surplus, but it has not been accompanied by an inflow of foreign currency (dollars), meaning the stabilization of the yen will proceed gradually.”

“Japan is anxious about the interest repayments for national debt which means it has the financial risk of not being able to increase base rates easily,” said Group Head Bobby Byun. “Interest rates for Japanese government bonds are rising due to the Bank of Japan’s reducing the amount of government bonds it purchases and when you consider the difference between Japanese and U.S. interest rates, it is hard to see a situation arising where the yen becoming stronger against the dollar.”

Export Risk: Potential for price competitiveness of key Japanese exports to hurt Korean exports

Saang Joon Baak, professor of international research and education at Waseda University, gave a presentation on “The Effects of the Weak Yen on the Korean Economy and How to Respond”.

“As competition between Korean, Japanese, and Chinese companies has grown, the three countries’ currencies have been similar,” said Professor Baak. “Japanese companies have not dropped their product prices as much as the yen has depreciated, meaning they are able to maximize operating profit, but if the won does not depreciate like the yen, then Korean companies’ operating profits will take a hit.”

"Considering the similar industrial and export structures of Korea, Japan, and China, it is inevitable that the currencies of the three countries will become more correlated," said Sang-hyun Park, a researcher at Hi Investment & Securities, who also participated in the panel. "While Korean industries and companies are struggling with the U.S.-led supply chain reorganization, the prolonged super weak yen is causing considerable damage to the Korean domestic economy."

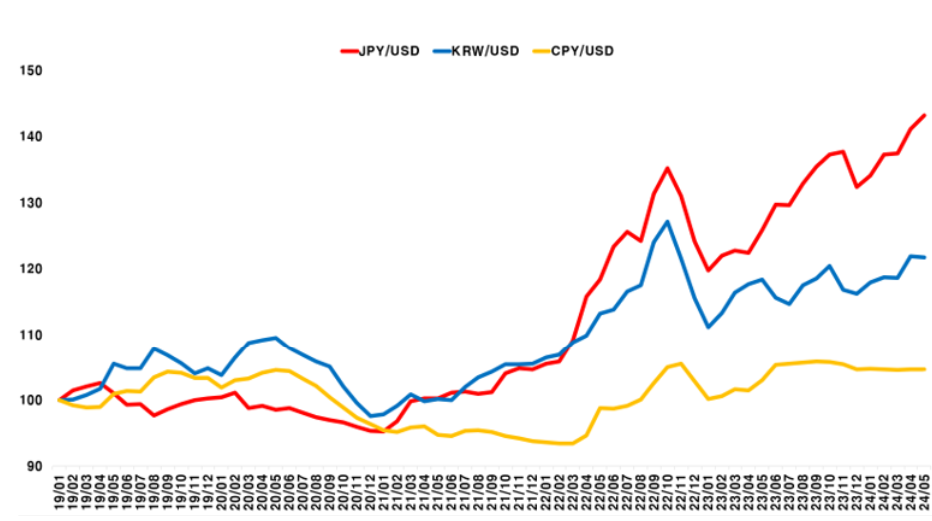

Trend of Won, Yen, and Yuan to Dollar Exchange Rates over the Last 5 Years (Jan. 2019 = 100)

Regarding the risks to the Korean financial market due to a weak yen, Jeong referred to the possibility of liquidation of yen carry trades 9 and said, "Japanese funds that have been attracted by the interest rate differential between Korea and Japan are likely to be liquidated after the positive shift in the Japanese base rate (-0.1% → 0.1% (March 2024))." "If the funds are withdrawn from Korea and emerging markets, the financial markets of those countries will be unstable, and if the yen strengthens after the withdrawal, the global financial markets may become volatile."

9 The current weakness of the yen, which is said to be contributing to the rise of currencies and asset prices in major economies around the world, and the increase in the Japanese central bank's base rate in March, which has narrowed the gap between interest rates in investor countries, have reduced the attractiveness of investing in emerging economies compared to the past.

"If the weak yen grows even weaker, major exporting countries, including Korea, will be negatively affected, and there will be no benefit to Japan," said Chul Chung, Chief Research Officer of FKI and President of KERI, who chaired the panel. "To mitigate the impact of the super weak yen, efforts to strengthen export support, including R&D for export items with high export similarity with Japan, are needed."

[Attached] Outlook and Measures for the Crashing Yen Seminar Overview