News & Events

Press Releases

July Business Survey Index (BSI) Released

|

July BSI Remains Sluggish at 96.8, With Big Gap Between Sectors (Manufacturing 88.5, Service 105.5)

• Overall BSI outlook (96.8) remains negative for 28 months straight since April 2022 (99.1)

• Manufacturing (88.5) at its lowest since January (87.0)

• Non-Manufacturing (105.5), first favorable outlook in 7 months after December 2023 (100.5)

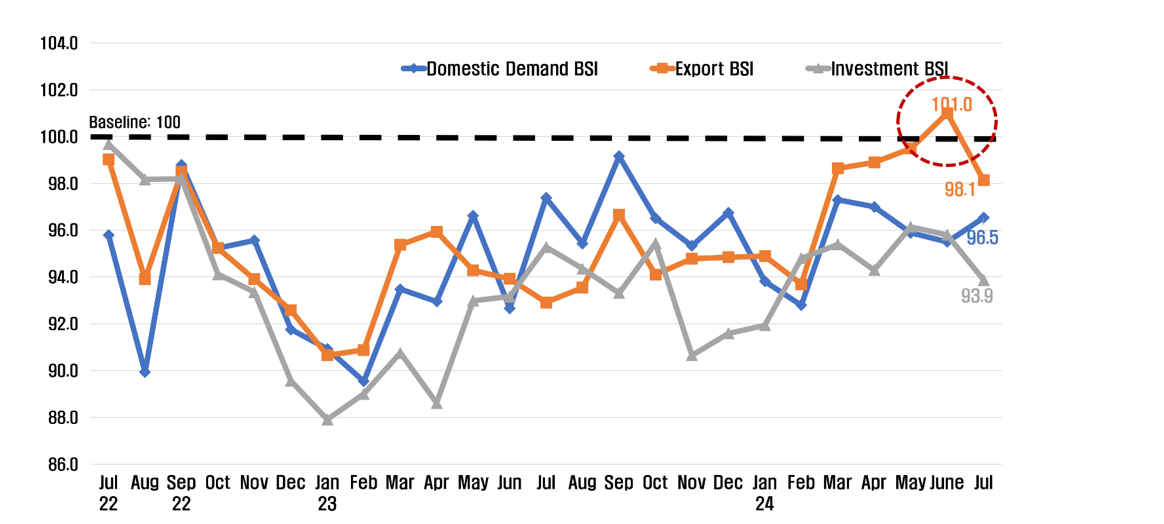

• Exports (98.1) negative again after just one month, triple negative outlook for exports (98.1), domestic demand (96.5) and investment (93.9)

* Exports: 101.0 (June) → 98.1 (July)

• Regulatory legislation amendments (such as expanding the scope of directors' fiduciary duties) should be off the table to stabilize business sentiment

BSI Trend for All Sectors

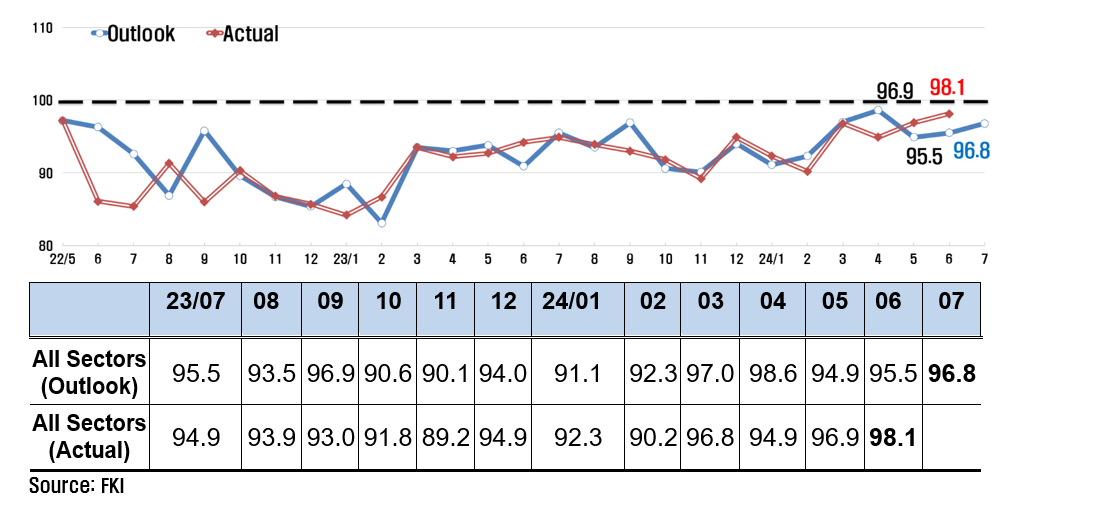

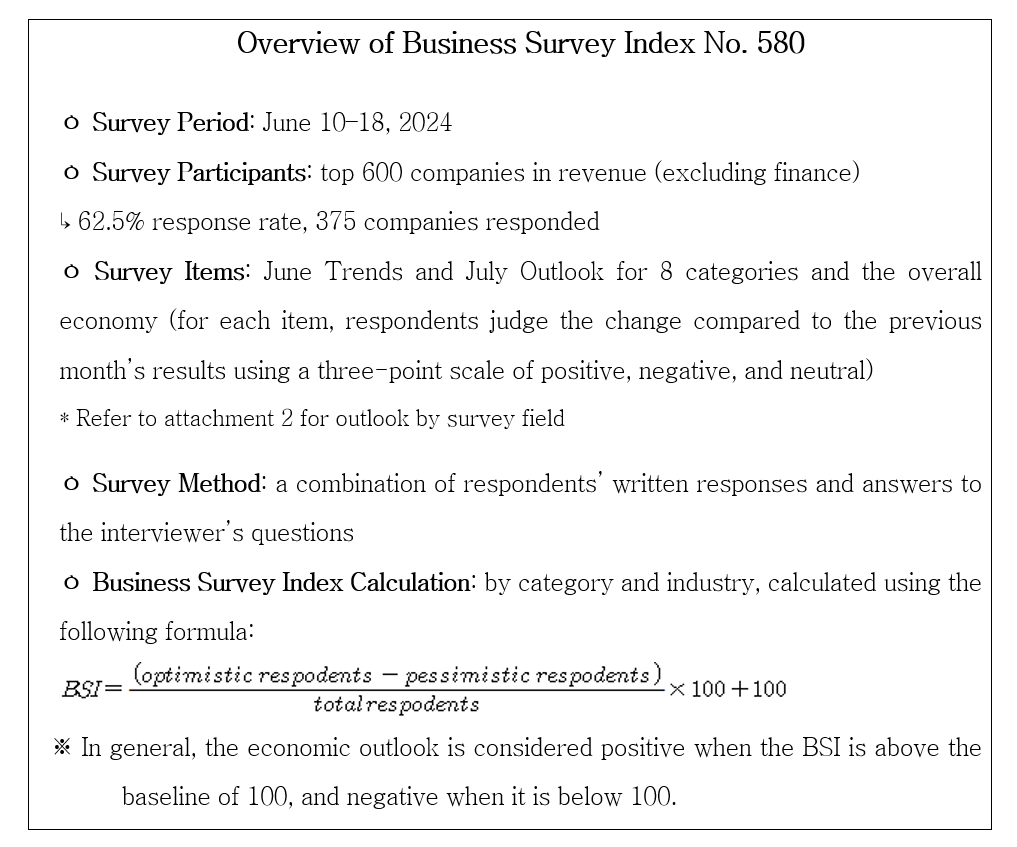

The Federation of Korean Industries (FKI)’s Business Survey Index (BSI), a survey of the business sentiment of the largest 600 Korean companies in revenue, recorded an outlook for July of 96.8, falling short of the baseline of 1001) . This means the BSI has now been negative for 28 months straight since April 2022 (99.1).

1 If the BSI is over 100, business sentiment is more positive about the economy than the previous month and vice versa.

The actual BSI for May was 98.1, which is the 29th negative result since February 2022 (91.5), indicating that business performance continues to be sluggish.

BSI Trend for Manufacturing and Non-Manufacturing Sectors

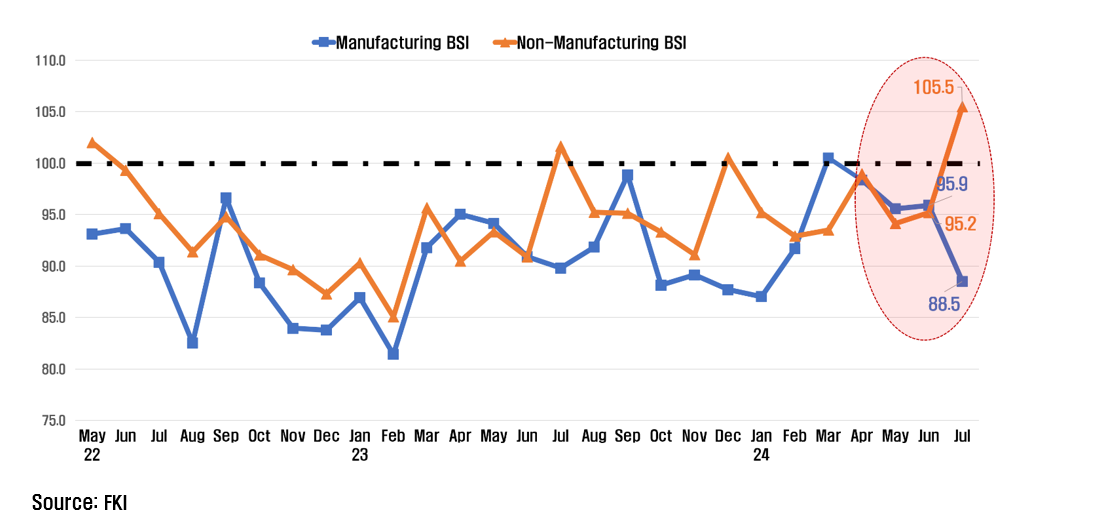

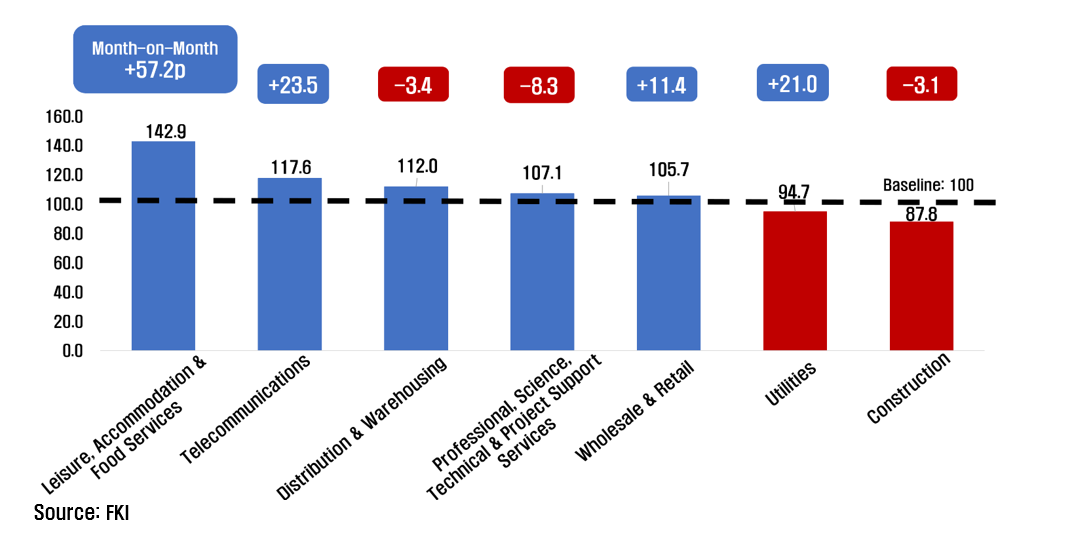

Amongst the 7 non-manufacturing industries, leisure, accommodation & food services (142.9), telecommunications (117.6), distribution & warehousing (112.0), professional, science, technical & project support services (107.1) and wholesale & retail (105.7) recorded a positive outlook. Utilities (94.7) and construction (87.8) were the only two industries to record a negative outlook below the baseline of 100.

The FKI viewed the rise in the non-manufacturing sector BSI to be mainly due to the expectations for increased seasonal demand in leisure, accommodation & food services (142.9) and distribution & warehousing (112.0), as well as telecommunications (117.6) getting a boost from the strong IT market.

BSI Trend for Domestic Demand, Exports & Investment

When looking at the survey fields for the July BSI, exports (98.1), employment (97.3), domestic demand (96.5), funds (94.9), profitability (94.1), investment (93.9) and inventory (104.35) ) were all negative. In particular, the outlook for exports which had briefly turned positive for June, became negative once again, meaning domestic demand, exports and investment were all negative.

5 If inventory is over 100 it signifies excess inventory and thus is also negative.

"The outlook for the manufacturing industry in H2 is very bleak due to concerns about the potential for an economic slowdown in major export destinations such as the United States and China," said Sang-ho Lee, vice president of the FKI’s Economic and Industrial Research Department. "To stabilize business sentiment, it is necessary to avoid discussions on legislation amendments that would dampen business vitality, such as the Commercial Act (expanding the scope of directors' fiduciary duties) and the Trade Union and Labor Relations Adjustment Act (aka the 'yellow envelope bill)."

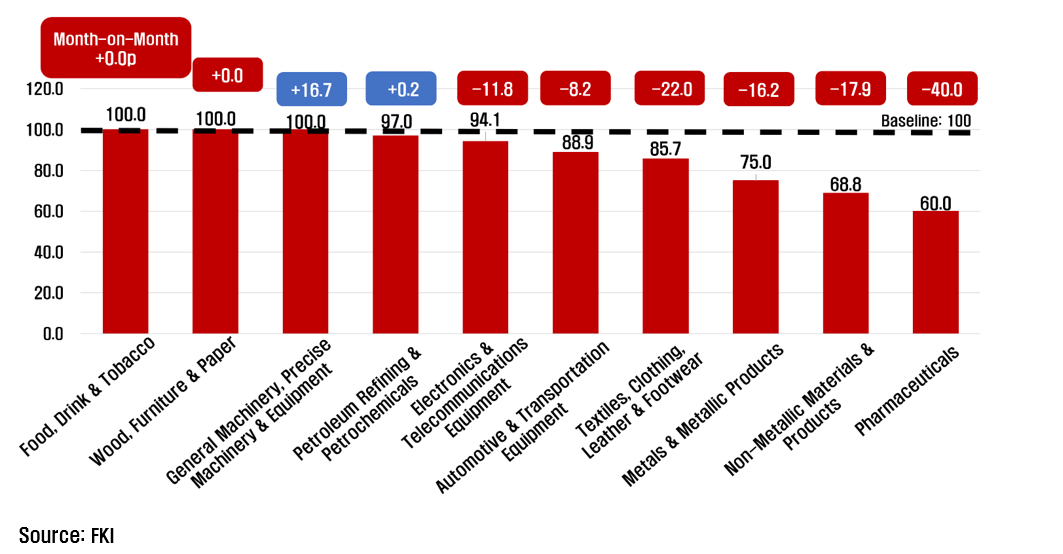

[Attachment 1] Outlook by Sector

[Attachment 2] Outlook by Survey Field