News & Events

Press Releases

Scaling Up Business Growth Seminar

|

FKI Holds "Scaling Up Business Growth" Seminar

- Discussed measures to help businesses grow such as regulatory reform and fiscal & tax support measures -

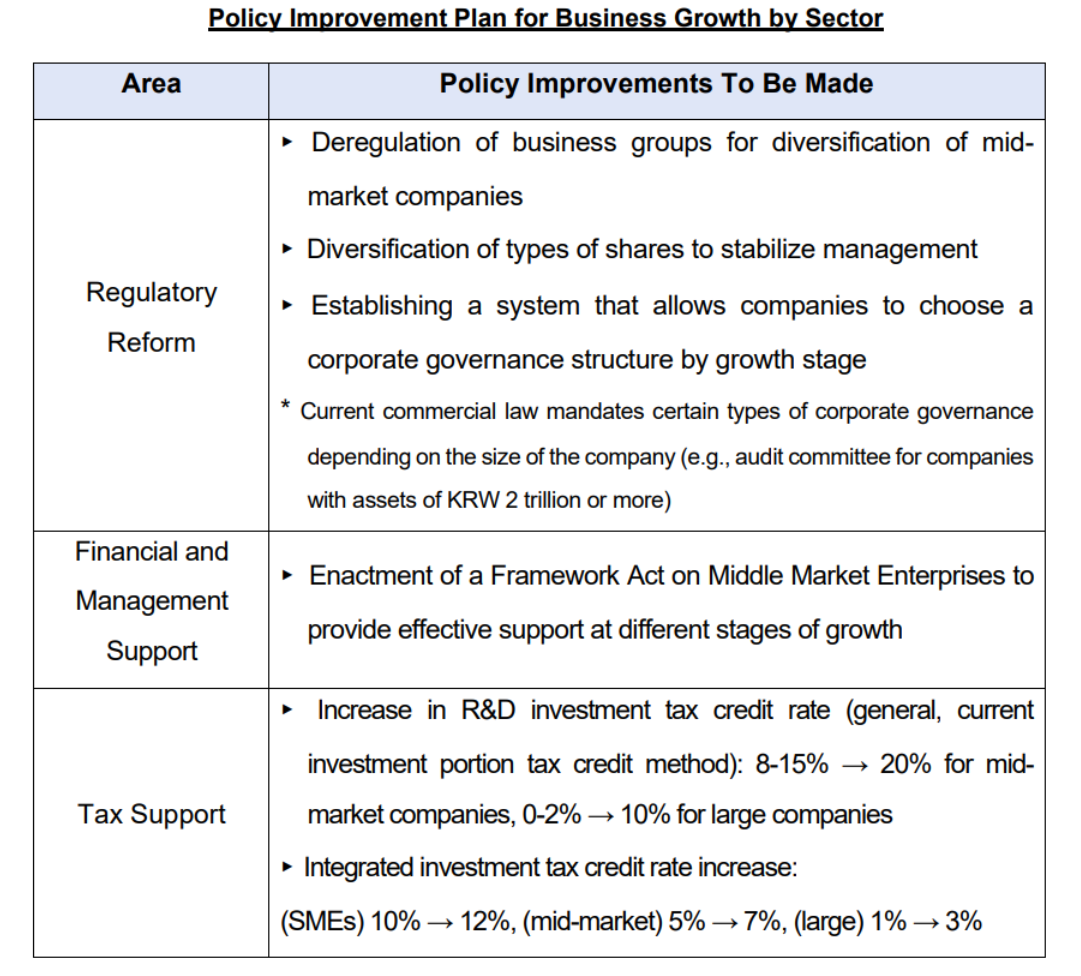

• Regulatory reform: ➀ Deregulate conglomerates ➁ Diversify types of shares 1)

• Financial and management support: Enact a ‘Framework Act on Middle Market Enterprises' to support each stage of growth

• Tax support: Increase the R&D and facility investment tax credit rates for middle market and large enterprises

1 Other types of shares: Shares that, unlike common shares, have special rights to profit dividends, distribution of surplus assets, voting rights, and more (e.g., preferred shares).

Discriminatory regulations on companies according to their size, which only exist in Korea, should be relaxed to facilitate companies' seamless growth and boost economic vitality. This was the view put forward at the seminar on "Scaling Up Business Growth" held by The Federation of Korean Industries (FKI) on June 3 at the FKI Tower Conference Center with the Korean Academy of High Potential Enterprises and the Federation of Middle Market Enterprises of Korea.

"Samsung and Hyundai also started as small rice and auto repair shops"

- FKI Chairman Jin Roy Ryu

"The proportion of conglomerates in Korea is only 0.09%, 33rd 2) out of the 34 OECD countries," said FKI Chairman Jin Roy Ryu in his welcoming remarks. "We need institutional improvements to support SMEs and mid-market enterprises to grow into conglomerates, following in the footsteps of Samsung and Hyundai, which started out as a small rice shop and an auto repair shop."

2 Percentage of conglomerates in major countries (2023, FKI): United States (0.88%), Canada (0.80%), Germany (0.44%), Japan (0.40%), United Kingdom (0.31%).

"The key to facilitating business growth is to eliminate the Peter Pan syndrome where businesses are reluctant to grow," said Jongho Kwon, chairman of the Korean Academy of High Potential Enterprises, in his opening remarks. "In particular, we need to eliminate the Peter Pan syndrome through intensive support for mid-market enterprises in industries with high growth potential such as materials, parts, and equipment for strategic technologies and future industries."

In his welcoming remarks, Jin Shik Choi, chairman of the Federation of Middle Market Enterprises of Korea, said, "Our mid-market enterprises, the ‘backbone' of the Korean economy, are a huge achievement that has been possible through decades of constant investment, challenges, and dedication." "We should accelerate the reform of regulations that hinder the growth of companies, such as inheritance and gift taxes, so as not to undermine entrepreneurship and the foundation for growth," he said.

In his congratulatory remarks, 1st Vice Minister of Trade, Industry and Energy Kyungsung Kang emphasized the importance of middle market enterprises, which account for 18% of all exports, and said, "We announced the 'Business Growth Scale-Up Plan' (June 3) today to promote the continuous growth of middle market enterprises and enhance the dynamism of our economy, and we plan to smoothly implement measures to promote growth and ease the burden on middle market enterprises, such as customized support for expanding special cases, export, finance, and human resources."

Conglomerate regulation reform is needed to help mid-market companies diversify

The first speaker, Professor Kwanhoon Kwak of Sun Moon University, said, "to diversify business and financing methods for the growth of SMEs and mid-market firms, relevant regulations need to be reformed".

Prof. Kwak identified improving regulations 3) on business groups as the first task to promote business diversification. He pointed out that mid-market companies often become a business group to diversify their business and grow, but the uniform regulation of business groups hinders their scalability.

3 ➀ Regulation of business groups subject to disclosure: Disclosure of the status of business groups, disclosure of large-scale internal transactions such as board resolutions, and prohibition of personal gains through internal trading; ➁ Regulation of business groups subject to mutual investment restrictions: All regulations for business groups subject to disclosure, prohibition of mutual investment, prohibition of circular shareholding, prohibition of debt guarantee, etc.

"Mid-market companies often use bank loans rather than capital markets for financing, which limits their growth," said Prof. Kwak. "To solve this growth problem, it is necessary to diversify the types of shares 4) , which will stabilize business management."

4 e.g. If the introduction of differential voting rights strengthens management control, it becomes easier to raise funds in the direct financial market through the issuance of additional shares.

Enactment of a Framework Act on Middle Market Enterprises is necessary to systematize their scope

Professor Dae Hong Kim of Soongsil University, who gave the second presentation, said, "There is a special act for middle-standing enterprises 5) , but it is centered on special cases for regulation and theoretical contents, so it does not stipulate specific support measures." He added, "It is necessary to enact a framework act for middle-standing enterprises with detailed content to provide effective support for them."

5 Enacted in 2013 as the Special Act On The Promotion Of Growth And The Strengthening Of Competitiveness Of Middle-standing Enterprises.

"To differentiate support for mid-market companies by growth stage, the Special Act on Middle-standing Enterprises needs to divide middle-standing enterprises into 'growth-promoting middle-standing enterprises' 6) and 'innovation-capable middle-standing enterprises' 7) to provide customized support."

6 Mid-market companies that that have entered the mid-market from SMEs and need support so that they will not be shocked by the sudden discontinuation of support measures.

7 Mid-market companies that are expanding their market dominance by competing, trading, and collaborating with global companies in markets with high growth potential.

Excessive discrimination in tax incentives according to business size (investment, employment, and R&D tax credit rates) should be reduced

Finally, Prof. Hyun Seok Yoon of Wonkwang University presented on 'Tax Support for Scaling Up Companies'.

"The tax credit rate for mid-market and large companies should be expanded to mitigate the adverse effects of the sharp reduction in tax support as companies grow," said Prof. Yoon.

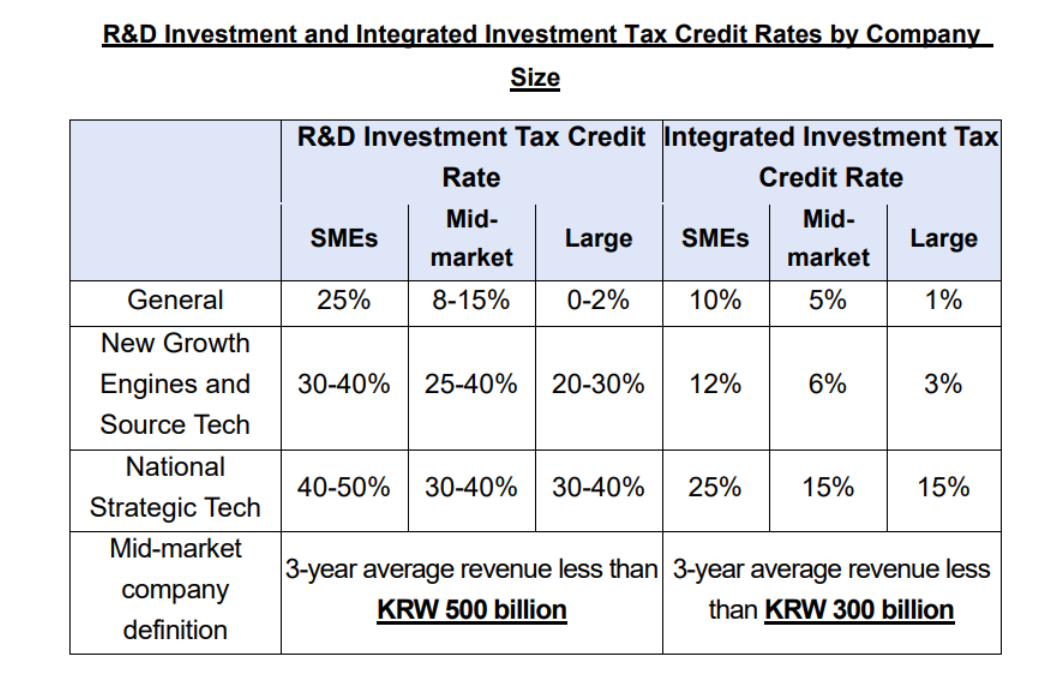

The current tax system reduces support for R&D investment as companies grow larger. The tax credit rate for R&D investment is 25% for SMEs, compared to 8-15% for midsize companies and 0-2% for large companies. It was pointed out that R&D is risky regardless of the size of the company, and it is unreasonable to have a differential tax credit.

To solve this problem, Prof. Yoon said that "the tax credit rate 8) for R&D investments should be increased to 20% for middle market firms and to 10% for large firms." "The tax credit rate for general facility investment (integrated investment tax credit rate) should also be increased to 7% for mid-market enterprises and 3% for large enterprises, from the current 5% and 1% respectively," he added.

8 Based on the deduction method for general and current investment

Korea's discriminatory regulations on business growth should be abolished

"To facilitate business growth, we need to ease regulations that are not in line with global standards and are unique to Korea and abolish discriminatory regulation 9) that companies face as they grow," said Yang Kyun Park, head of the Policy Department at FOMEK, during the panel discussion.

9 The number of regulations for becoming a large company has increased to 342 in 61 laws (06/2023, FKI)

"As stated in the legislative purpose of the Middle-standing Enterprises Special Act 10) , it is necessary to amend the relevant laws to provide comprehensive support for middle-standing enterprises to grow into 'global specialty companies'," said Mr. Seongheon Oh, managing partner at OhKims Law.

10 “The purpose of this Act is to prescribe matters necessary to promote the growth and enhance the competitiveness of middle-standing enterprises into specialized global enterprises” (Article 1 of the Special Act On The Promotion Of Growth And The Strengthening Of Competitiveness Of Middle-standing Enterprises)

[Attached] Overview of Scaling Up Business Growth Seminar