News & Events

Press Releases

June Business Survey Index (BSI) Released

|

June BSI sluggish at 95.5, while semiconductors and exports exceed baseline of 100

• Overall BSI outlook (95.5) remains negative for 27 months straight since April 2022

• Manufacturing (95.9) and non-manufacturing (95.2) sectors both sluggish

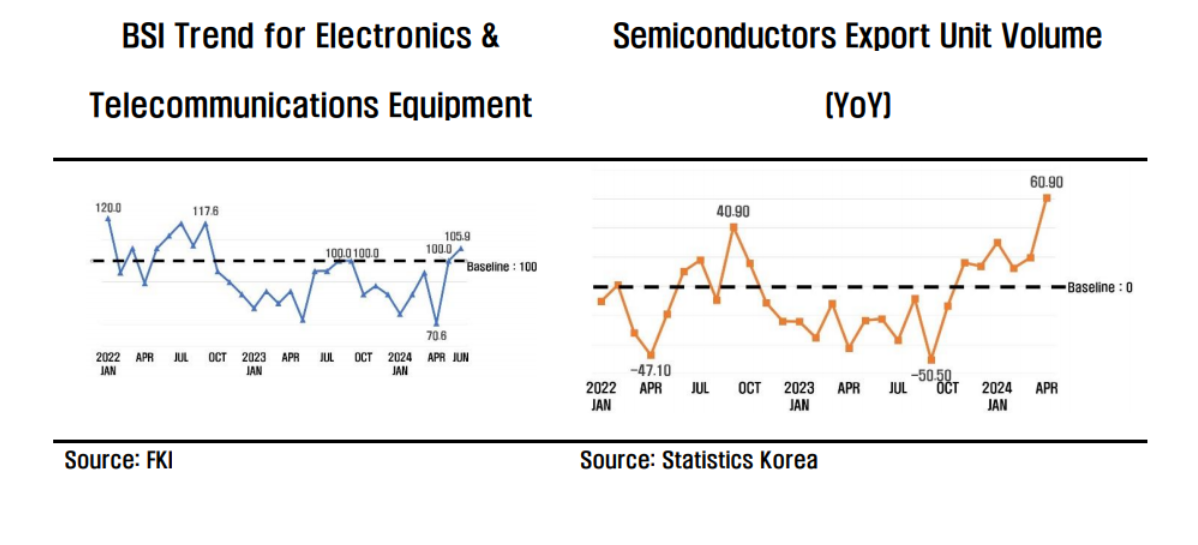

* The electronics & telecommunications equipment (105.9) industry, which includes semiconductors, crossed the baseline of 100 for the first time in 21 months since October 2022

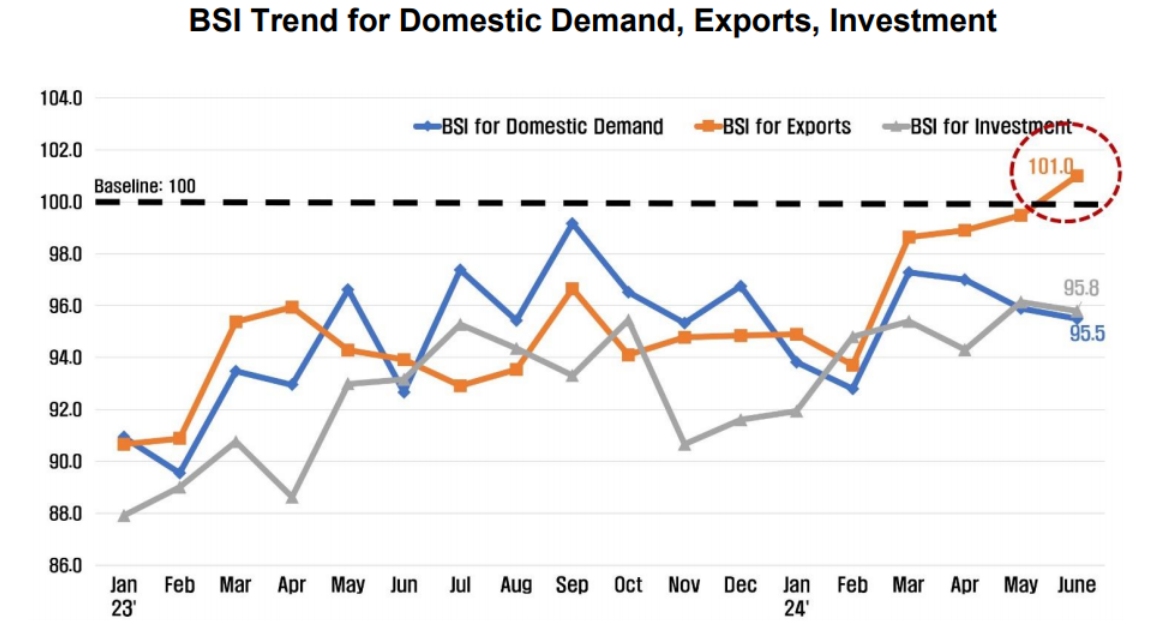

• Exports (101.0) positive for the first time in 27 months since April 2022, domestic demand (95.5) and investment (95.8) remain sluggish

• Need to boost business vitality so that export growth can spread to the broader real economy

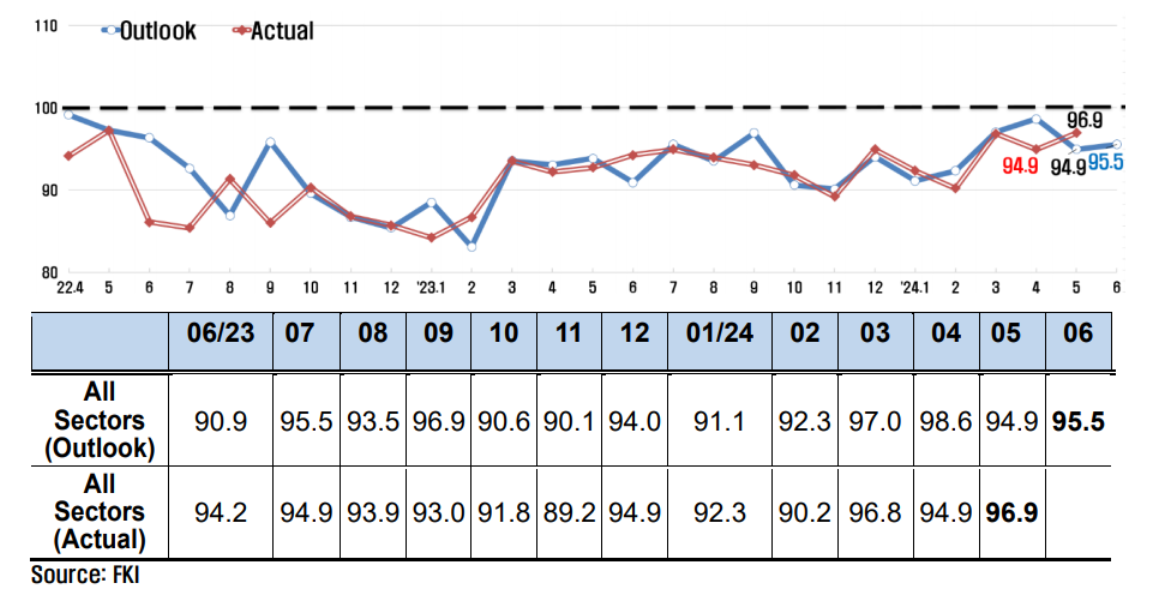

BSI Trend for All Sectors

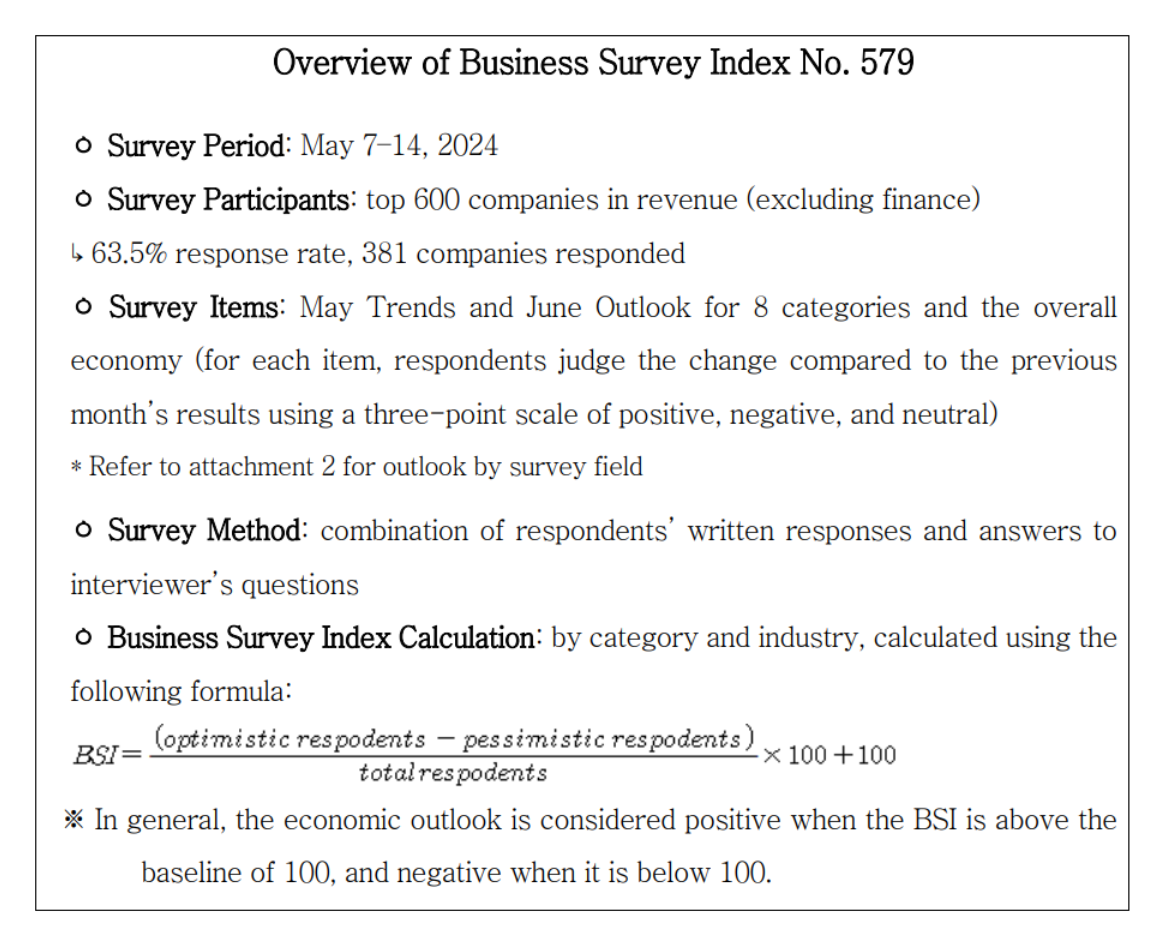

The Federation of Korean Industries (FKI)’s Business Survey Index (BSI), a survey of the business sentiment of the largest 600 Korean companies in revenue, recorded an outlook for June of 95.5, falling short of the baseline of 100 1 . This means the BSI has now been negative for 27 months straight since April 2022 (99.1).

1 If the BSI is over 100, business sentiment is more positive about the economy than the previous month and vice versa.

However, the electronics & telecommunications equipment (105.9) industry, which includes semiconductors, and exports (101.0) have crossed the baseline of 100 for the first time since October 2022 (95.0) and April 2022 (97.4) respectively, raising expectations for an improvement across other industries.

The actual BSI for May was 96.9, indicating that business performance continues to deteriorate.

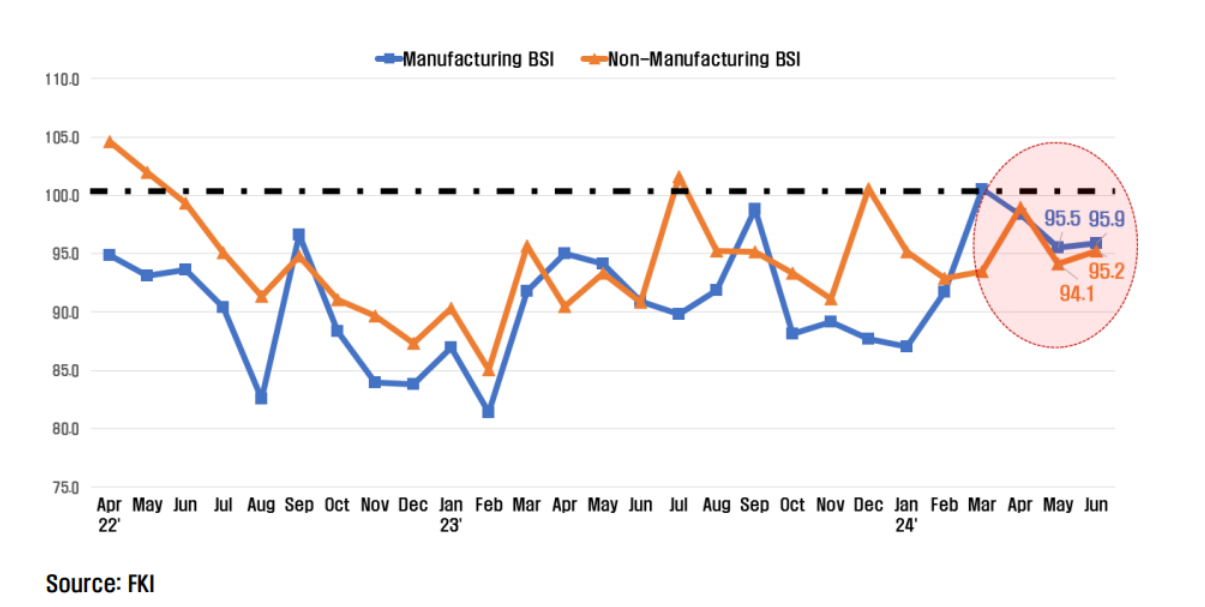

BSI Trend for Manufacturing and Non-Manufacturing Sectors

The outlook for June is poor for both the manufacturing (95.9) and non-manufacturing (95.2) sectors. The manufacturing sector outlook 2 rose to 100.5 in March before falling below the baseline again, now for the third month in a row. The non-manufacturing sector outlook 3 increased by 1.1 points compared to the April outlook (94.1) to 95.2, remaining sluggish for 6 months since January.

2 Manufacturing BSI Outlook: 100.5 (03/24), 98.4 (04/24), 95.5 (05/24), 95.9 (06/24)

3 Non-Manufacturing BSI Outlook: 100.5 (12/23), 95.2 (01/24), 92.9 (02/24), 93.5 (03/24), 98.9 (04/24) 94.1 (05/24), 95.2 (06/24)

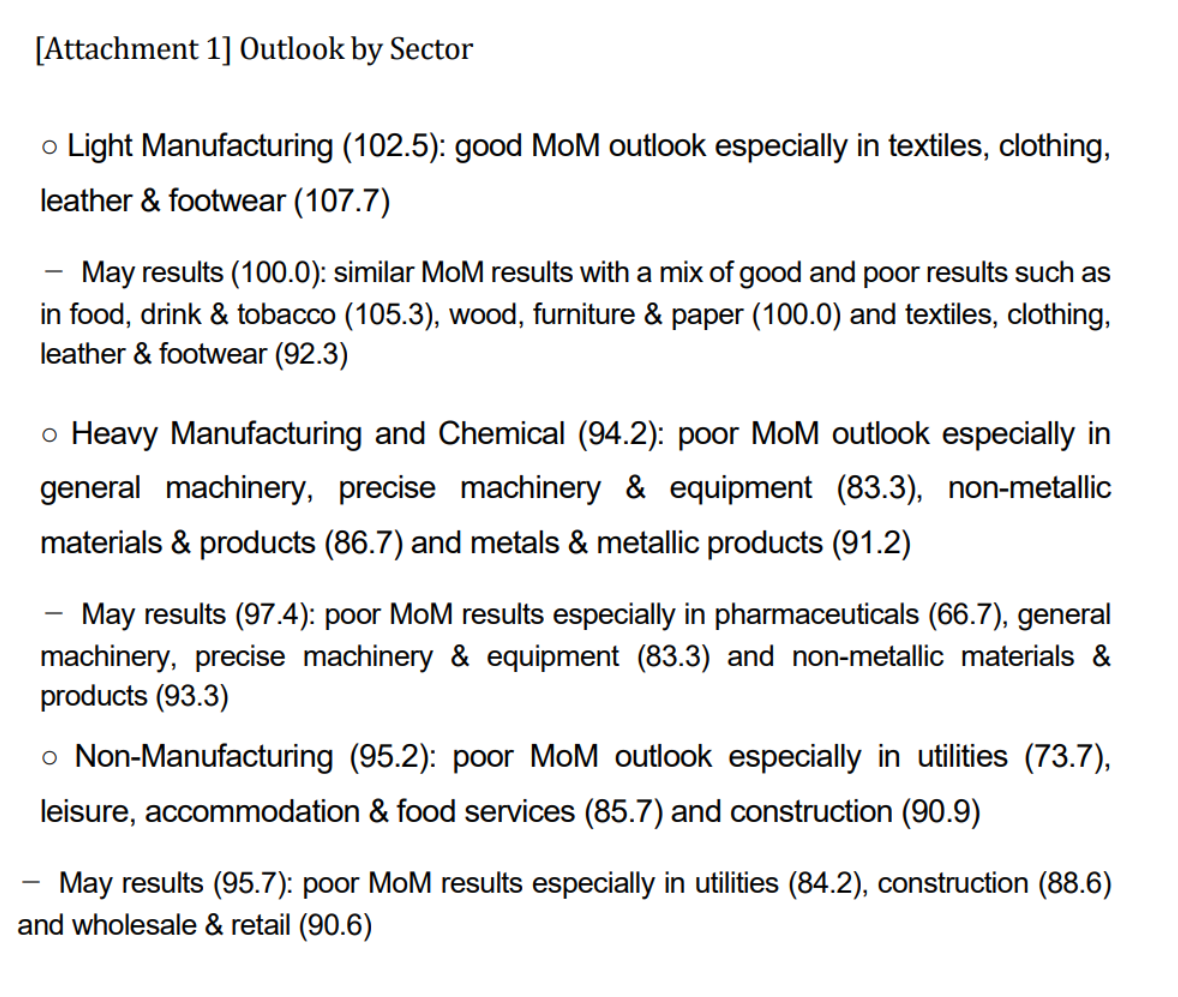

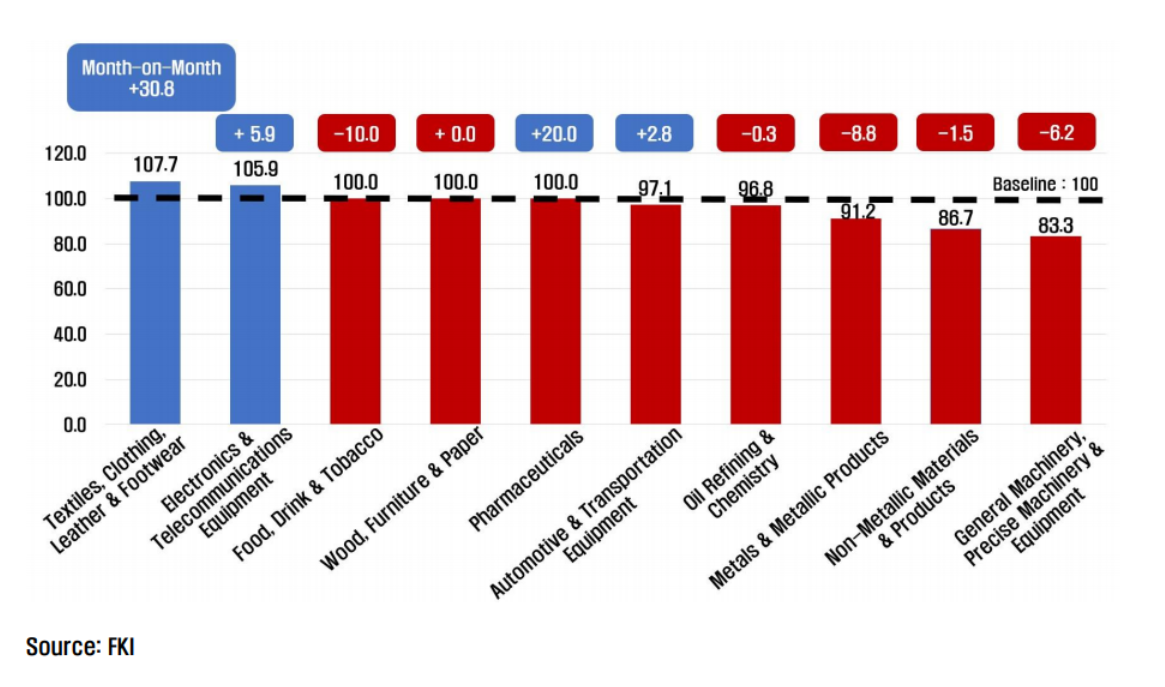

June BSI For Manufacturing Industries

Amongst the 10 manufacturing industries, textiles, clothing, leather & footwear (107.7), which is expected to have higher demand with the summer season approaching, and electronics & telecommunications equipment (105.9), that includes semiconductors which are in high demand, both had a positive outlook. Wood, furniture & paper, pharmaceuticals and food, drink & tobacco landed on the baseline while the remaining 5 industries 4 fell below 100.

4 Automotive & transportation equipment (97.1), oil refining & chemicals (96.8), metals & metallic products (91.2), non-metallic materials & products (86.7), general machinery, precise machinery & equipment (83.3)

The electronics & telecommunications equipment (105.9) industry, which includes semiconductors, crossed the baseline of 100 for the first time in 21 months since October 2022 (95.0). The FKI attributed the improvement in business confidence in the industry to the increase in semiconductors exports due to greater global demand.

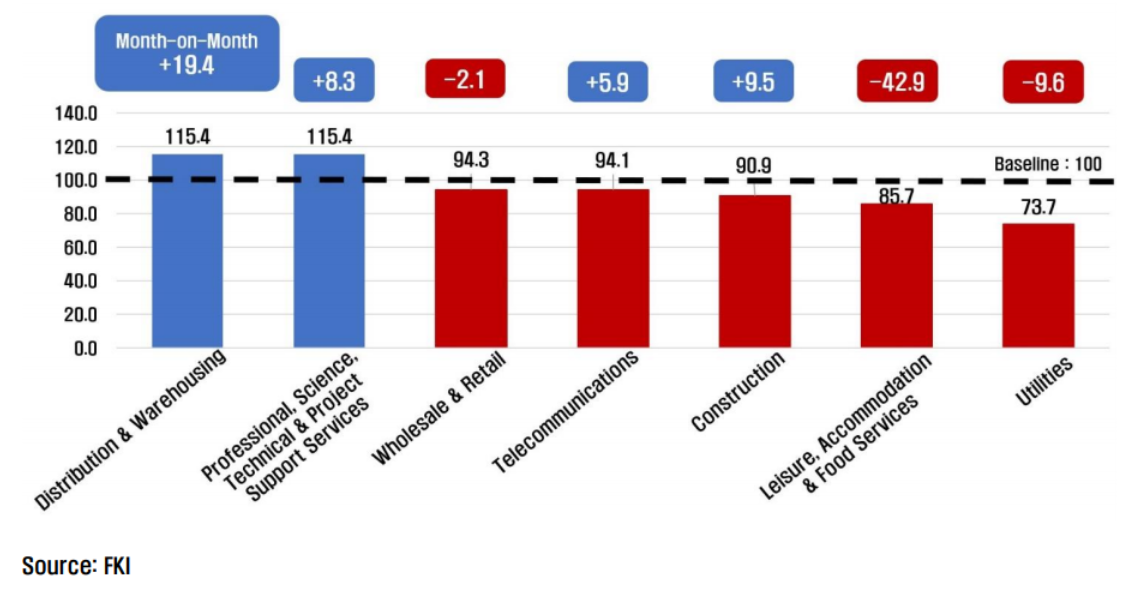

June BSI For Non-Manufacturing Industries

Amongst the 7 non-manufacturing industries, the distribution & warehousing (115.4) industry, which is expected to have higher demand in the upcoming summer vacation season, and the professional, science, technical & project support services (115.4) industry had positive outlooks. The wholesale & retail industry (94.3) and the remaining 5 industries 5 all had a negative outlook.

5 Telecommunications (94.1), construction (90.9), leisure, accommodation & food services (85.7) and utilities (73.7)

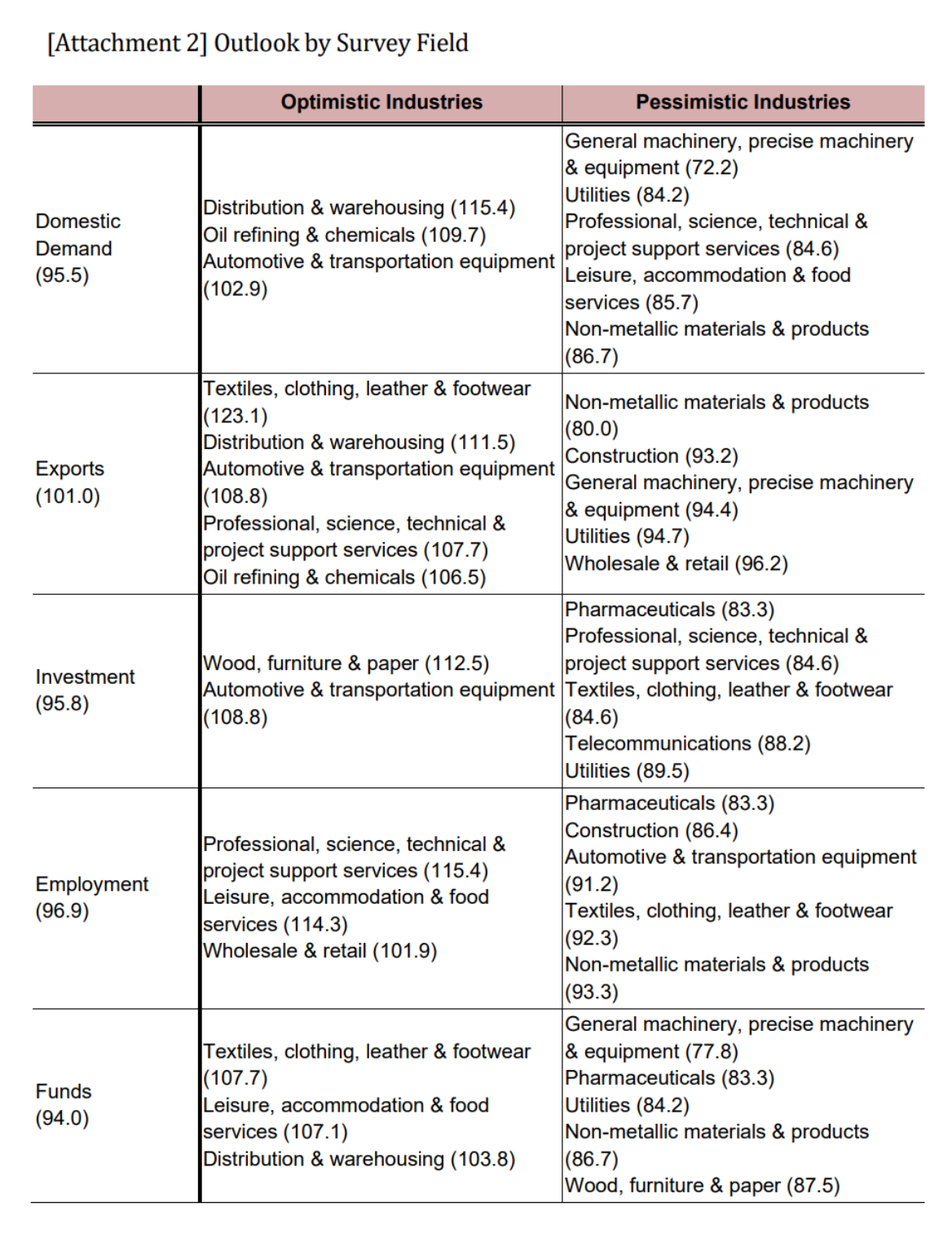

When looking at the survey fields for the June BSI, as anxiety surrounding the Middle East situation eases and semiconductor exports improve, the exports (101.0) survey field turned positive. This is the first time exports have been above the baseline in 27 months since April 2022 (97.4).

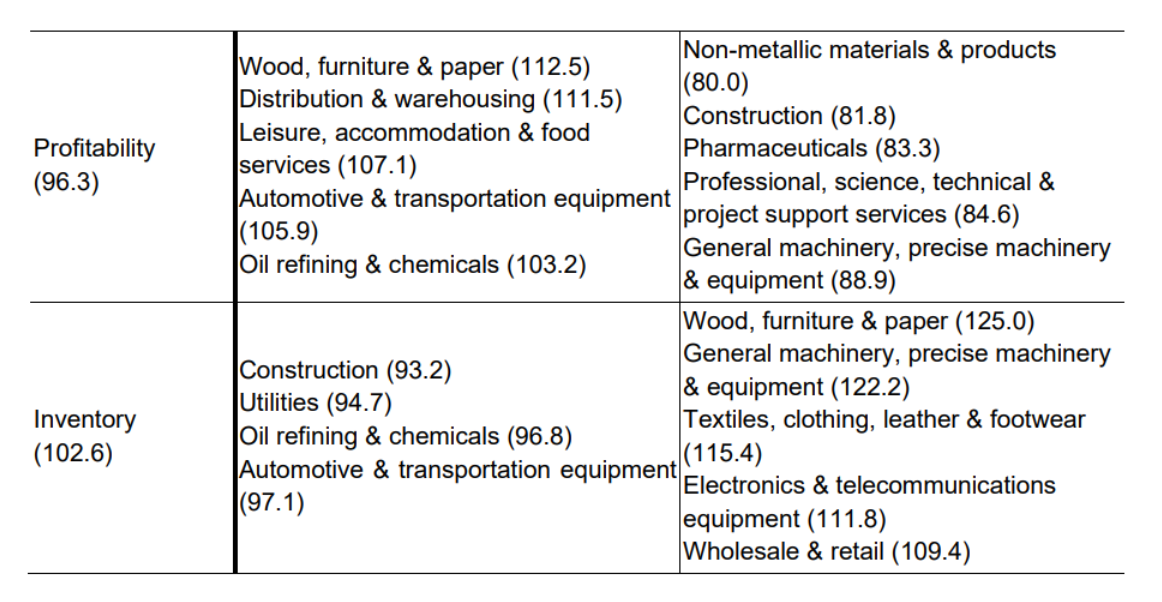

However, besides exports, every survey field had a negative outlook. Employment was 96.9; profitability, 96.3; investment, 95.8; domestic demand, 95.5; funds, 94.0; and inventory, 102.6 6. Despite the positive switch for exports, domestic demand and investment continue to remain under the baseline, now for 24 months straight since July 2022 (95.8 and 99.7 respectively).

6 If inventory is over 100 it signifies excess inventory and thus is also negative

While domestic demand and investment remain sluggish, the improving semiconductor and export industries are raising expectations of an economic recovery,” said Sang-ho Lee, vice president of the FKI’s Economic and Industrial Research Department. “Therefore, we need to boost business vitality through domestic demand promotion and investment support measures so that the strong export growth can spread to the real economy as a whole."