88% of Chinese companies and 50% of Japanese companies “want to work with Korean companies the most” 1

- FKI commissions a survey on economic cooperation between Korea, Japan and China -

• Japanese and Chinese companies express interest in working with Korean companies

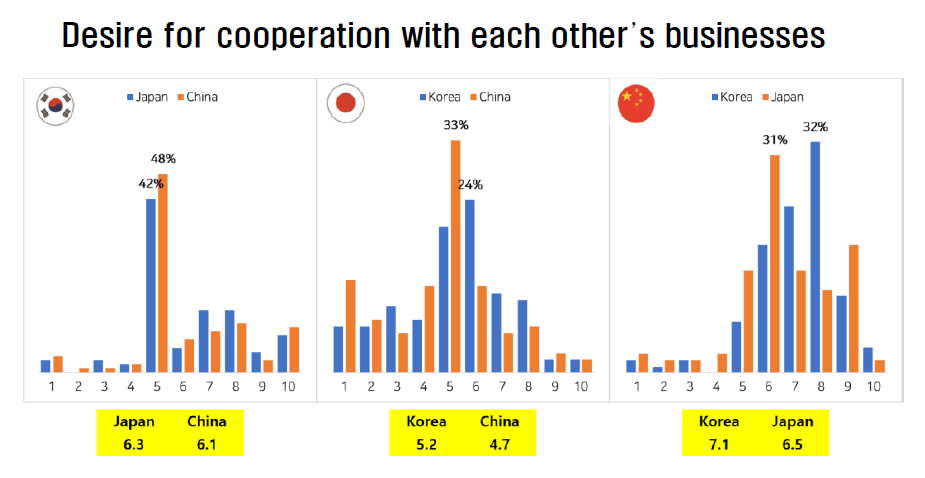

* Japanese companies’ preferred partner: Korea (5.2) > China (4.7)

* Chinese companies’ preferred partner: Korea (7.1/10) > Japan (6.5)2

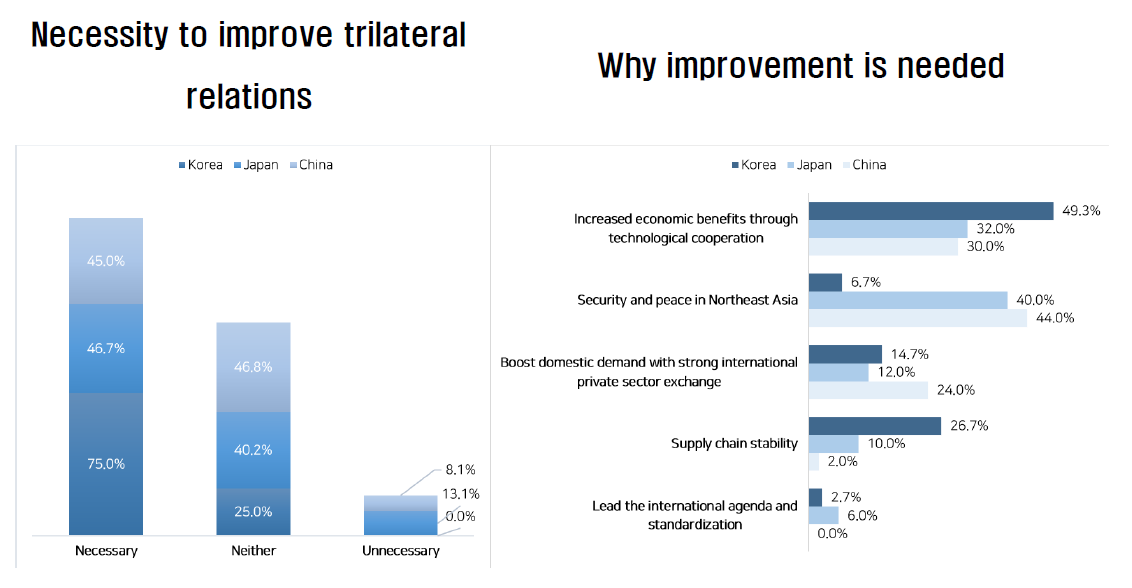

• Trilateral relationship: “relations need to improve” (Korea: 75%, Japan: 46.7%, China: 45%), opinions differ on reason necessary

* Top reason chosen – Korea: “increase economic benefits” (49.3%), Japan and China: peace in Northeast Asia” (40%, 44%)

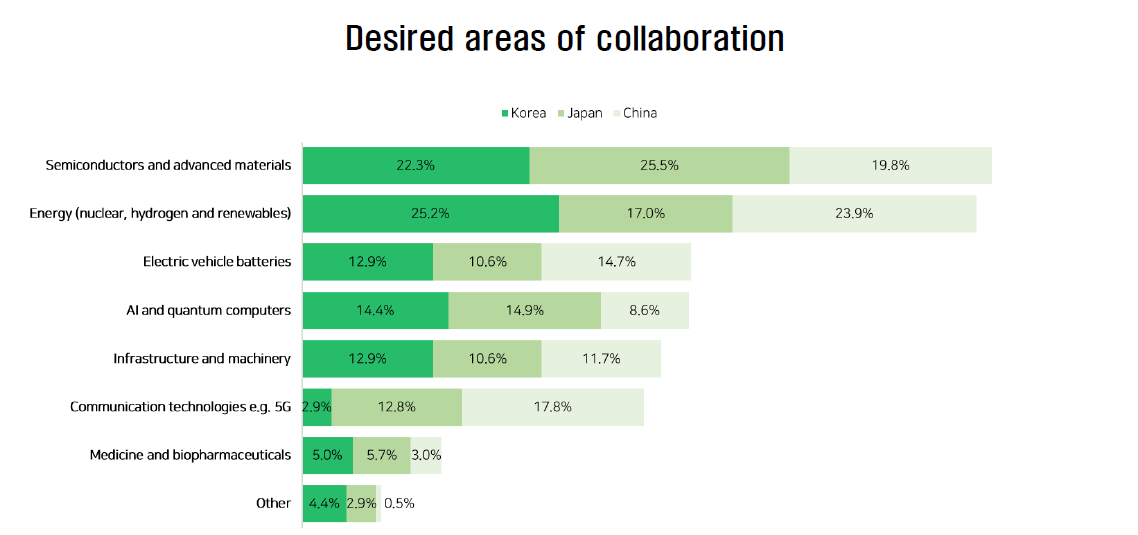

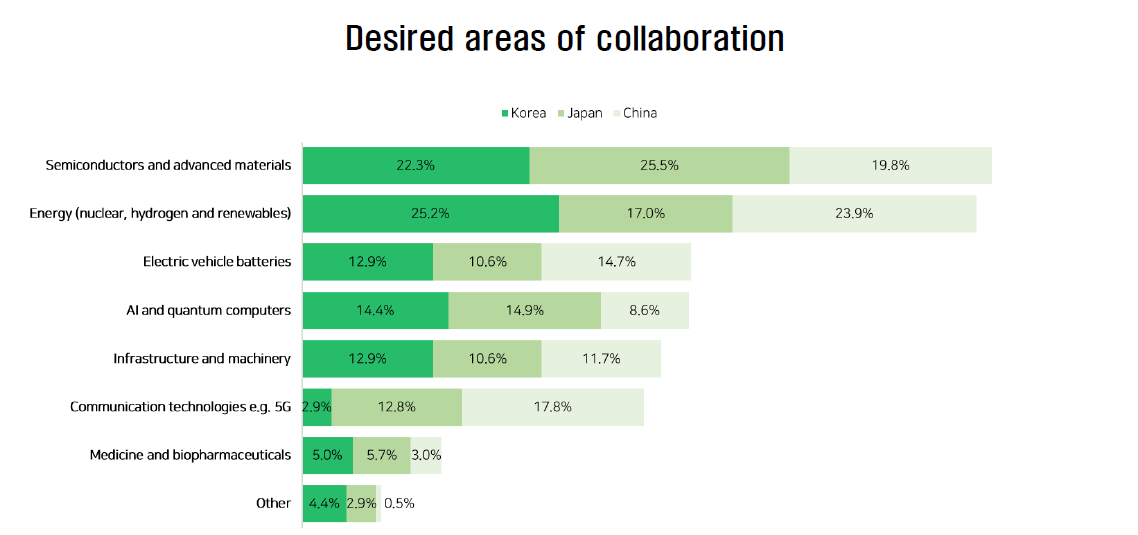

• Most desired areas for trilateral cooperation:

Korea and China - nuclear power, hydrogen, renewable energy Japan - semiconductors and advanced materials

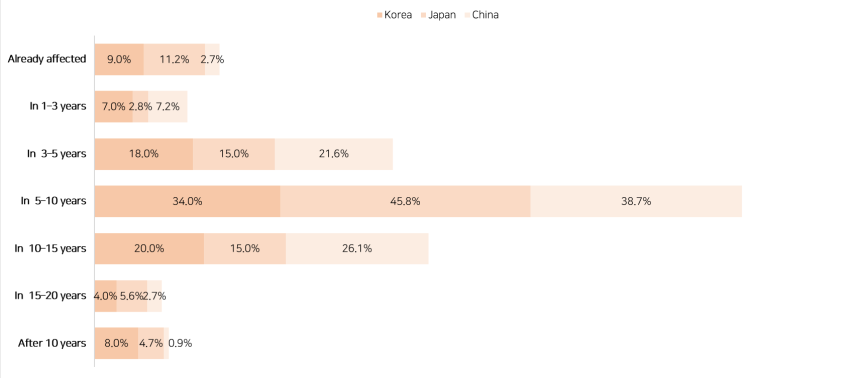

• Low fertility rate and aging population: all 3 countries concerned they will face a shortage of key workers within 5–10 years

1. Companies with moderate intention to cooperate (6 points) or higher: 98 out of 111 Chinese companies and 53 out of 107 Japanese companies.

2. The higher the score from 1 (low willingness to cooperate) to 10 (high willingness to cooperate), the higher the willingness to cooperate with the other country's companies.

Companies in Korea, Japan, and China recognize the need to improve relations among the three countries for mutual economic benefits and peace in Northeast Asia, and Japanese and Chinese companies both prefer Korean companies as their first choice for cooperation.

The Federation of Korean Industries (FKI) revealed this in its "Survey on Korea-Japan-China Economic Cooperation" a survey of the top 1,000 manufacturing companies in revenue (as of 2022) in each of the three countries (100 respondents from Korea, 107 from Japan, and 111 from China) ahead of the Korea-Japan-China Trilateral Summit (May 26-27). This is the first time that the FKI has conducted a joint survey on large Korean, Japanese, and Chinese companies regarding economic issues.

Why relations should improve: Korea - Economic benefits from technological cooperation, Japan and China - Security and peace in Northeast Asia

When asked about their willingness to cooperate with companies from other countries, Japanese and Chinese companies were both more willing to cooperate with Korean companies.

Based on a 10-point scale, Japanese companies were more likely to want to cooperate with Korean companies (5.2 points3 ) than Chinese companies (4.7), and Chinese companies were also more likely to cooperate with Korean companies (7.1) than Japanese companies (6.5). Korean companies were willing to cooperate with Japanese companies (6.3) and Chinese companies (6.1) to a similar degree.

3. All scores are averages.

Korean companies were the most emphatic about the need to improve relations between the three countries, with 75% of Korean companies, 46.7% of Japanese companies and 45% of Chinese companies saying there is a need to improve trilateral relations.

Korean companies cited “increased economic benefits through technological cooperation” (49.3%) and “supply chain stability” (26.7%) as the main reasons that relations should be improved. For Chinese and Japanese companies, “security and peace in Northeast Asia” (Japan 40%, China 44%) were more important than “increased economic benefits through technological cooperation” (Japan 32%, China 30%).

Desired areas of cooperation: Japan – semiconductors and advanced materials, China: nuclear, hydrogen and renewable energy

When asked what areas they would like to collaborate with their counterparts in, Japanese companies chose “semiconductors and advanced materials” (25.5%) as their first choice, followed by “nuclear, hydrogen and renewable energy” (17%).

Korean and Chinese companies prioritized “nuclear, hydrogen and renewable energy” (25.2% in Korea and 23.9% in China), which is related to stable power supply and climate change, followed by “semiconductors and advanced materials” (22.3% in Korea and 19.8% in China).

Other industries included “electric vehicle batteries” (12.7%), “AI and quantum computers” (12.6%), “infrastructure and machinery” (11.7%), and “communication technologies such as 5G” (11.2%). 4

4. Scores in this paragraph are average of all 3 countries.

Economic issues: China - weakening of growth engines due to economic downturn, Korea and Japan - commodity price volatility

“Commodity price volatility” due to the global trend of the triple whammy (high interest rates, high exchange rates and high inflation) was chosen as the top issue by Korean and Japanese companies (38% in Korea and 35% in Japan). Chinese companies cited the “weakening of economic growth engines due to the domestic economic slowdown5 ” as the top economic issue (42.3%).

5. IMF China Economic Growth Rate Forecast (April 2024) - 2023: 5.2%, 2024: 4.6%, 2025: 4.1%

Export risks: Korea and China - declining demand due to low global growth, Japan - supply chain volatility

In addition, Korean and Chinese firms cited a “decline in demand due to slow global economic growth” as the top export risk (34.0% in Korea and 29.7% in China), while Japanese firms cited “supply chain volatility” 6 (30.8%) as the top risk to their exports.

When asked when they think the economy will recover, among Korean and Japanese companies the most common answer was that it has already recovered (25% in Korea and 57% in Japan), while the most common answer from Chinese companies was that it will recover in the second half of 2025 (24.3%).

6. Supply chain risks such as the U.S China trade war and Middle East risks like the Israel-Hamas war (potential for a blockade of the Strait of Hormuz in the Persian Gulf, which carries about 20 percent of the world's cargo, including oil and natural gas) are constant.

Low fertility rate and aging population: labor force decline is severe in all three countries, with labor shortage expected in 5–10 years

Across all three countries, companies perceive the decline in the labor force due to the declining fertility rate and an aging population as “serious” (81% in Korea, 77.6% in Japan, 62.2% in China) and expect a shortage of key workers in “5–10 years” (34% in Korea, 45.8% in Japan, 38.7% in China).

Timing of key worker shortage due to low fertility rate and aging population

Companies in the three countries cited the following as effective measures to support maternity and childcare: “parental leave system” (54% in Korea, 51.7% in Japan, 33.1% in China), “implementation of flexible work arrangements” (25.3% in Korea, 25.9% in Japan, 25% in China), and “provision of maternity and childcare subsidies” (14.7% in Korea, 11.9% in Japan, 27% in China).

"Korea, Japan, and China are countries with many globally competitive companies in key industries, and there will be great synergies through technological cooperation as relations improve," said Sang-ho Lee, vice president of the FKI’s Economic and Industrial Research Department. "This years’ trilateral summit should strengthen cooperation among the three countries' business communities to lay the foundation for prosperity in Northeast Asia."