News & Events

Press Releases

FKI Global Zoom – Seminar Series ① “Global Economic Turbulence: Prospects and Implications for the World and Korean Economy”

|

Possibility of No U.S. Interest Rate Cuts in 2024, Fed Tightening Cycle Could Resume in 2025

FKI invites speaker Adam S. Posen, president of the Peterson Institute for International Economics, the leading think tank on the international economy

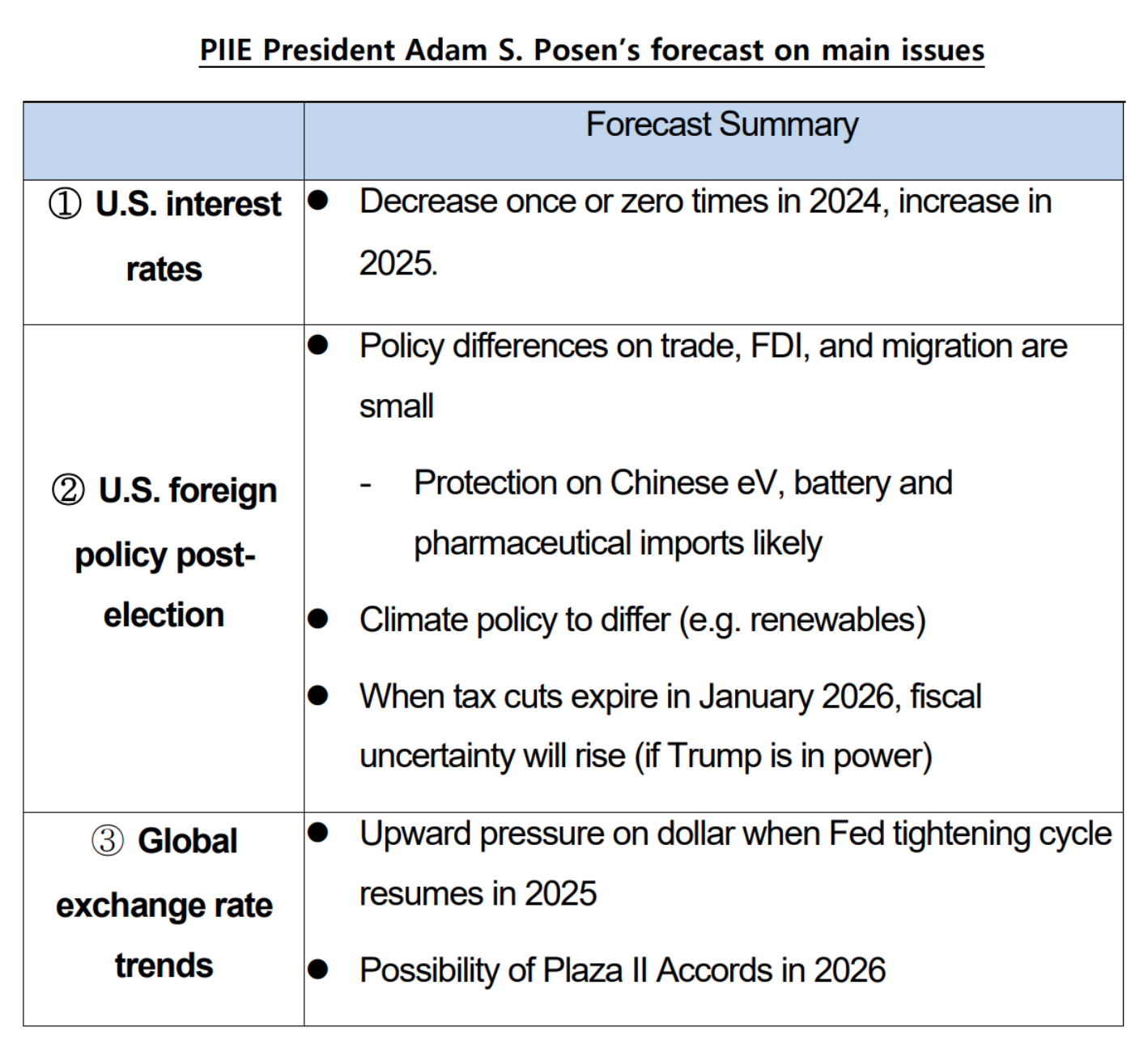

• U.S. benchmark interest rate: Due to continued inflation, Fed could cut interest rates only once or zero times this year, and even raise rates next year

* U.S. 10-year Treasury bond rates forecast to increase over the next few years due to drop in demand, etc.

• Election: The next U.S. administration will maintain many of the hostile trade, FDI and migration policies regardless of who wins, result will affect climate policy

• Exchange rates: If Fed tightening cycle resumes in 2025, putting further upward pressure on dollar, could see Plaza II1 in 2026

• How we should respond: Put in place a contingency plan to manage oil prices and financial market instability

* Increase business competitiveness at the same time by increasing funding for cutting-edge industries and expanding investment tax credits

1 Plaza Accord: Agreement between finance ministers of G5 countries made at the Plaza Hotel in New York in September 1985 to depreciate the U.S dollar against the other countries’ currencies

Amid rapid changes in the international landscape, such as the deteriorating situation in the Middle East and the uncertain direction of U.S. interest rates, the Federation of Korean Industries (FKI) held a seminar on April 30 (Tuesday) at the FKI Tower Conference Center in Yeouido to discuss the changing global business environment and how Korea should respond.

"Recently, Korean companies have been suffering from the triple whammy of high oil prices, high exchange rates, and high interest rates due to the deteriorating situation in the Middle East and continued global inflation," said Chang-beom Kim, vice chairman of the FKI. "It is necessary to stabilize the recent recovery of the domestic economy by closely examining risk factors in the rapidly changing global business environment and devise countermeasures in advance."

Fed to raise rates and strong dollar to continue in 2025, possibility of Plaza II in 2026

At the seminar, Adam S. Posen, president of the Peterson Institute for International Economics, gave the keynote presentation on "The Global Business Environment and How Korean Businesses Should Respond" focusing on three areas that could impact Korean businesses.

① U.S. interest rate outlook: "As the level of the U.S. neutral interest rate2 is rising and inflation is not falling, there will be no or only one rate cut in the U.S. this year, and the rate may increase next year," said Posen. In particular, "the real interest rate on the 10-year U.S. Treasury bond is likely to move upward in the coming years as the G7 and China increase their spending on defense, carbon, and industrial policies, Chinese capital flows to the West decrease, risk aversion decreases (which reduces demand for U.S. Treasuries), and productivity increases (due to the rising neutral rate)," he said, suggesting that we should prepare for a medium- to long-term upward trend in interest rates.

2 Neutral interest rate (r*): The level of interest rate that can maintain potential growth without inflation or deflation

② U.S. foreign economic policy following the U.S. presidential election: "The policy differences in trade, FDI, and immigration are likely to be small under a second Biden or second Trump administration," said Posen, who analyzed that "the first step (regardless of who wins) will be protectionist measures against Chinese imports of electric vehicles and batteries, followed by measures against Chinese pharmaceuticals."

However, Posen expects that "offshore export controls and sanctions will be much more aggressive and strictly enforced under a Biden second term than under a Trump second term," and that "climate policy will differ widely domestically, but not as much internationally."

"In January 2026, various tax cuts introduced in the first Biden administration (such as lower corporate tax rates) will expire, and interest rate and fiscal uncertainty would be much higher under Trump than Biden."

③ Global exchange rate trends: Commenting on the recent strength of the dollar, Posen pointed out that "the U.S. monetary tightening cycle will resume in 2025, putting additional upward pressure on the dollar," and that "rising inflation and fiscal deficits in the US could trigger a Plaza II 3 in 2026."

3 Politico (April 15) also reported on the possibility of the "Plaza Accord" of 1985 being re-implemented, in which the Japanese yen was allowed to appreciate in order to reduce the U.S.’s fiscal and trade deficits, if former President Trump is re-elected.

Top 3 risks for Korea: ➀ U.S. rate cut timing ➁ Strong U.S. dollar ➂ Slower growth in China

In his presentation on "Changes in the External Macroeconomic Environment and Risk Factors," Sung-Bae Ahn, vice-president of the Korea Institute for International Economic Policy (KIEP), pointed out that the Korean economy is facing three major risk factors - interest rates, exchange rates, and China - due to changes in the external macroeconomic environment, namely robust growth in the US, geopolitical conflicts in the Middle East, and China's transition into a medium- to long-term low-growth trend.

① U.S. interest rate risk: "The U.S. has a strong labor market, with an increase in the number of employed people and a decline in the unemployment rate, and consumer price inflation remained at a high level of 3% in March," Ahn said, explaining that “the timing 4 of interest rate cuts has emerged as the biggest risk factor as solid growth in the U.S. continues, which has triggered a stronger dollar.”

4 Chicago Mercantile Exchange (CME) FedWatch (as of April 26) December 2024 rate forecast: “no change” (20.2%), “one (0.25%p) cut” (39.5%), probability of the rate based on federal funds (FF) futures contrac

② Exchange rates risk: Secondly, he pointed out that "the recent fears of escalation between Israel and Iran has strengthened the dollar further as it stimulated demand for safe assets," and that "the exchange rate has emerged as a critical risk factor due to the geopolitical conflict in the Middle East." However, Ahn believes that Korea's foreign exchange position is strong, with the world's ninth-largest foreign exchange reserves at $419 billion, and as the country turned into a net foreign debtor in 2014, with net foreign financial assets projected to reach $778 billion by the end of 2023, the likelihood of a foreign exchange crisis is low.

③ China risk: Finally, "China's growth is expected to slow down in the medium to long term due to low total factor productivity compared to advanced economies, a shift away from export- and investment-led growth policies to the dual circulation strategy 5 and the prevention of real estate credit expansion, and the strategic measures imposed by the United States."

5 Dual circulation refers to the domestic circulation (domestic demand) and the international circulation (exports and imports) and refers to an economic development strategy that focuses on building a self-reliant economy centered on domestic demand as external uncertainties increase and synergizes the two aspects.

"Due to China's slowing growth, 'China risk' is a hot topic for Korean companies," said Ahn, adding that "Korean companies are preparing for the 'China risk' as their sales and purchases from their US and ASEAN businesses in 2018-2022 have increased significantly, while their activities in China have weakened."

How to respond: activate contingency plan to manage oil price spikes and calm financial market turmoil

"Although the Korean economy grew 1.3 percent in the first quarter due to strong exports and domestic demand, it is difficult to guarantee a solid economic rebound due to changes in the international situation, such as conflicts in the Middle East and the U.S. presidential election," said Chul Chung, president of the Korea Economic Research Institute (KERI) and chief research officer of the FKI, who chaired the session. "We need to prepare short- and long-term scenario-specific responses to global risks to mitigate uncertainty in business management."

"The recent depreciation of the won was triggered by short-term volatility in international financial markets rather than the fundamentals of the Korean economy," said Il-Houng Lee, former president of KIEP. "Indicators such as the recent short-term surge in international oil prices and the rise in the volatility index (CBOE VIX) were unstable, but they moved within a predictable range over the medium term." However, "unexpected complications are emerging, such as a delay in the timing of U.S. rate cuts, uncertainty in the demand for yen carry trades, continued short positions on Asian currencies, and preference for the U.S dollar due to geopolitical risks," he said, calling for close monitoring of changes in related indicators.

Gyeong-Lyeob Cho, a senior research fellow at KERI, called for fostering an environment to strengthen business competitiveness in order to overcome economic challenges caused by geopolitical risks and changes in the external economic environment. "Countries around the world are now striving to protect their own industries and promote business innovation activities for economic hegemony," Cho said. "As the creation of high-value-added industries and securing advanced technologies will determine future national competitiveness, companies should strive to discover new growth engines for the future, and the government should actively take measures such as subsidizing high-tech industries and expanding investment tax credits."

"The recent risks in the Middle East and the uncertainty of the Fed's rate cuts are expected to have adverse effects, such as a rebound in inflation, the U.S. dollar remaining strong, and an increase in borrowing rates," said Tae-soo Kang, professor at KAIST. "The government should focus on stabilizing financial market instability while responding to the spike in oil prices by launching a contingency plan."

[Attached] Seminar on Global Economic Turbulence: Prospects and Implications for the World and Korean Economy